Learn to act on short-term price movements

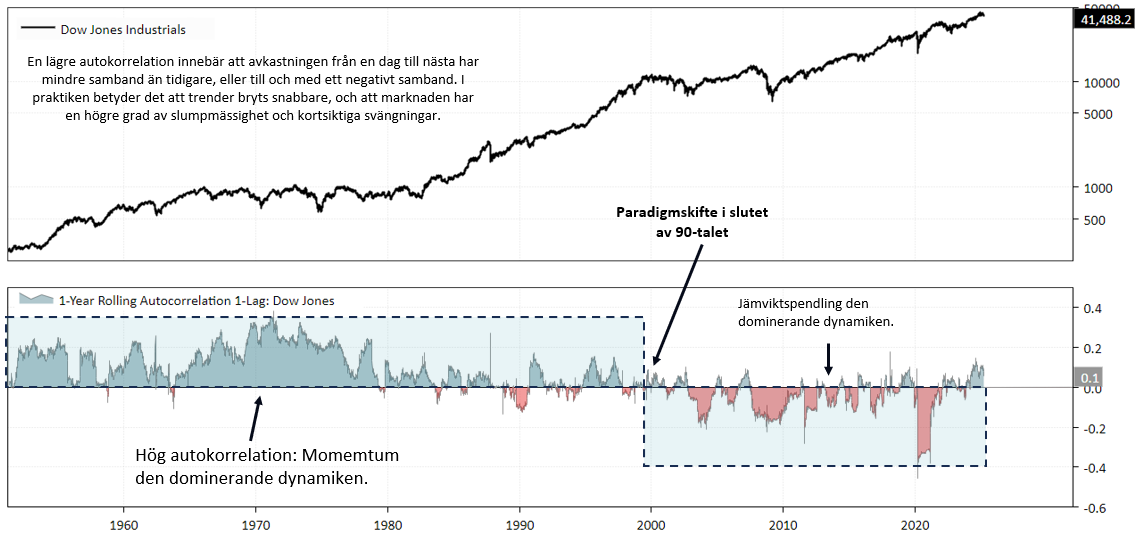

Many of the most widespread technical analysis strategies originate from a period when the market had higher autocorrelation – that is, the price tended to continue in the same direction even in the short term.

But those days are over. Today, autocorrelation is significantly lower, which makes many classic strategies less effective. Despite this, they continue to be taught by both the uninitiated and profiles who built their success in another era – without adapting to today's reality.

We have recently improved our equilibrium commuting model and, among other things, launched a weekly version of Trend & Trade Range.

The weekly variant is great for those who have limited time and don't want to be "stuck" in front of the screen. Signals are given after the last trading day of the week and trades are executed at the open on the first trading day of the week

We offer today's episode of Marknadspulsen where we go through equilibrium oscillation and how we can use Trend & Trade Range to act on short-term movements.

Learn more!

Would you like to receive more information, but are not a customer yet? We invite you to Friday's Market Pulse.

The section contains:

- Equilibrium commutation – what it is and how we use it

- The difference between discretionary and systematic working methods

- Our updated model: Trend & Trade Range

- Mean Reversion OMX och Mean Reversion ETF

- Summary with concrete insights

Then you can easily register a free demo account and gain access to more insights, strategies, and tools.