Has trend following on the Stockholm Stock Exchange stopped working?

Many people try to time the market with complex models and macro analysis. At the same time, a simple rule – following the long-term trend – has beaten most. But this strategy has had a tough time in recent years, especially on the Stockholm Stock Exchange. Has it stopped working?

Trend following is one of the simplest strategies there is. It requires no macro analysis, no guesswork about interest rates or geopolitics – just one rule: follow the trend. But that’s precisely why it’s hard to accept for many market participants who would rather try to be more insightful than the market.

Historically, it has worked very well.

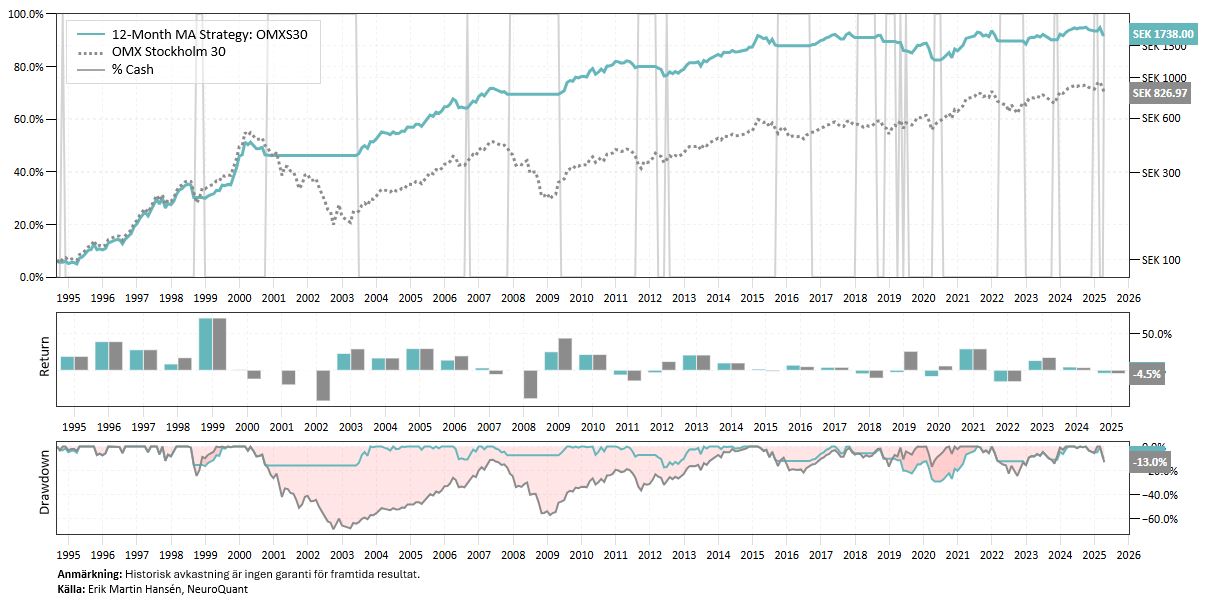

Below we see the development for one of the most common strategies where we buy OMXS30 and the index closes above the 12-month moving average and sell if the index closes below the 12-month moving average.

The strategy has outperformed a pure buy-and-hold strategy, with a Sharpe ratio of 0.68 and a maximum drawdown of only -29%. The stock market, by comparison, has had significantly worse risk-adjusted returns, with two sharp declines of 50-60%. The percentage of winning trades has been 60%, and the strategy has held its positions for an average of around 300 days – suggesting that it captures longer-term trends rather than short-term movements.

Something has happened in the last 10 years

Something has happened in the last 10 years

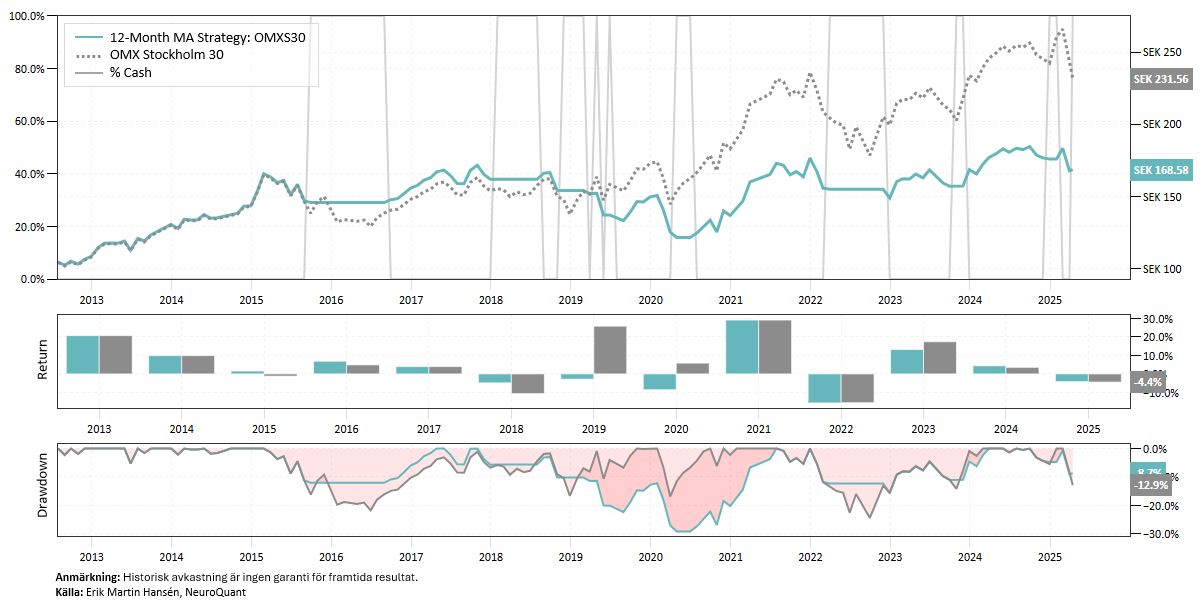

Over the past 10 years, the classic strategy, which previously helped investors avoid major downturns and capture long-term upswings, has yielded increasingly poor results. It has generated many false signals and weak performance.

During the 2000s, the OMXS30 has had several longer trend phases – both up and down – where trend-following models have produced good returns. However, in the last 10 years, the market has moved more choppily, with shorter ups and downs, often within the same range. Other global indices have had more and larger trends than the OMXS30.

The result? The model signals buy. The stock market turns down. The model signals sell. The stock market turns up. And so on.

This is the biggest problem for all trend-following strategies: when the market lacks sustained movements, the models lose their edge.

No improvement with 200-day moving average

No improvement with 200-day moving average

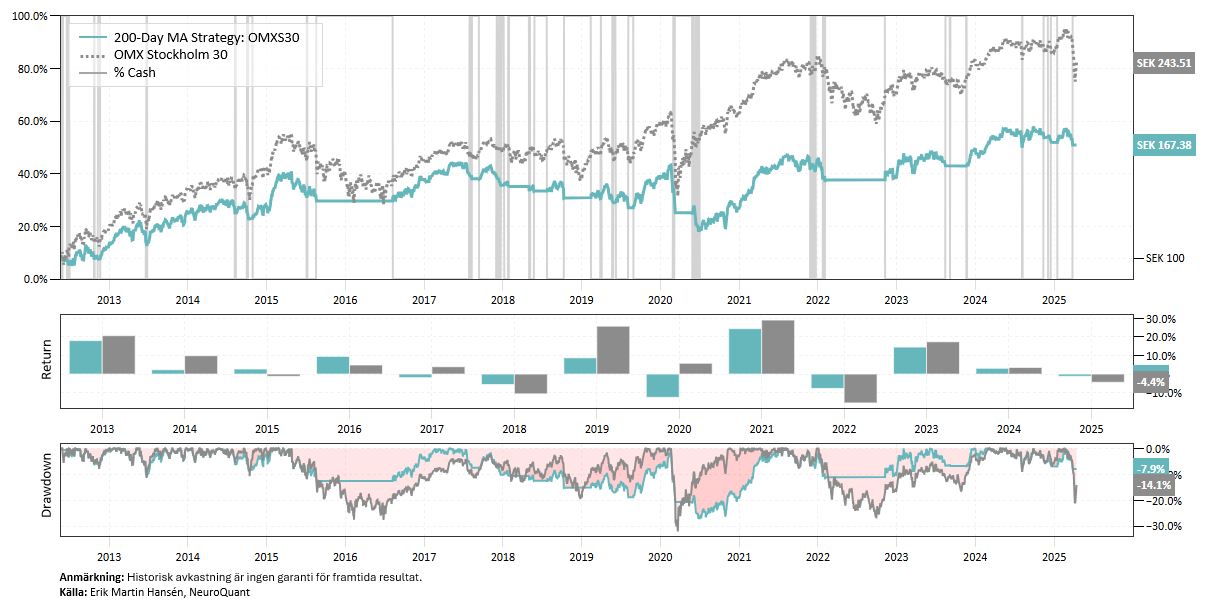

Many trend-following investors use the classic 200-day moving average. It can provide signals every day because it is based on days instead of months. However, it often produces a lot of noise – especially in sideways markets.

A lot of noise and mean reverting behavior means that monthly tuning provides fewer signals and often better filtering of temporary movements. It is a simple adjustment that often improves the result – without making the model less robust or risking over-optimization.

Below we see a backtest of a strategy that buys OMXS30 when the index rises above the 200-day moving average and sells when the index falls below the 200-day moving average. The percentage of winning trades has been only 31%.

Conclusion: Trend following doesn't always work – we adapt

Conclusion: Trend following doesn't always work – we adapt

There are no magic signals. No models that work everywhere, all the time. In order to follow trends, there must be trends to follow. To condemn the concept of trend following just because the Stockholm Stock Exchange had a turbulent decade would be to throw the baby out with the bathwater.

However, there are more powerful alternatives than simple moving averages. We offer dynamic strategies, which compares momentum across asset classes, for example. These strategies can further increase risk-adjusted returns – while avoiding long and boring downturns. Thanks to their low risk profile, leverage can be used to enhance returns in a controlled manner.

In our premium package includes buy and sell signals from just such strategies, built to be flexible, robust and adapted to the changing behavior of the market. However, like all strategies, they can have periods where they perform weaker – especially during major regime shifts. Therefore, diversification and patience are always important parts of successful investment work.