Monthly Update: Value & Momentum

Value & Momentum is a strategy that aims to identify companies with good fundamentals and positive market behavior. Portfolio weights are adjusted for volatility and changes are made once a month. With patience, discipline and systematic position management, we have good conditions to outperform over time.

Our factor-based equity strategies are included in the premium package. On the page model portfolios The holdings and portfolio weights are reported. Click here to read more about our strategies on the website.

Information

- Direction: Long only (no short positions)

- Strategic direction: Attractive valuations (value) and strong price momentum (momentum).

- Investment universe: Primarily Swedish stocks. The selection may also include Nordic companies.

- Portfolio weights: Volatility-adjusted (all holdings are allowed to participate and contribute equally)

- Rebalancing frequency: Monthly

Development

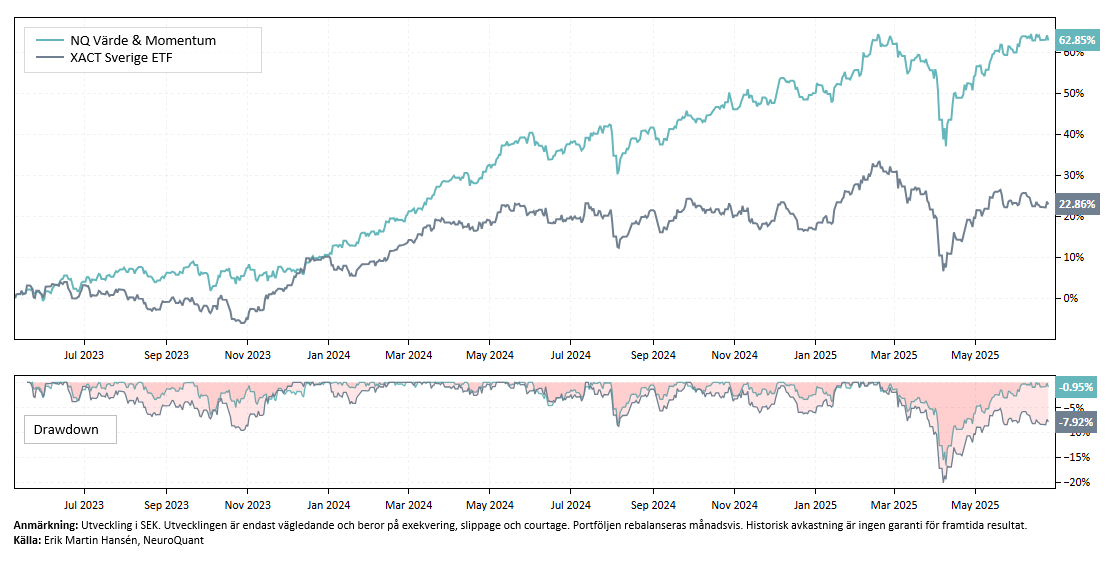

Since its inception in 2023, the Value & Momentum portfolio has risen by 62.9%, compared to the Stockholm Stock Exchange's broad index (XACT Sweden) which has increased by 22.9% during the same period. The Sharpe ratio has been 2.3 – compared to the stock market's 0.5. A higher Sharpe ratio means that the portfolio has provided more return per unit of risk. The portfolio's beta has been 0.4, with a correlation to the market of 0.6.

The strategy combines valuation with trend strength and has thereby managed to avoid so-called value traps – i.e. low-valued stocks that continue to lose value. This type of holding is difficult to avoid for those who invest discretionarily without clear rules. With a systematic approach, however, it becomes easier to stay out of loser stocks and focus on companies that are both cheap and showing strength.

| Year | Jan | Feb | Mar | Apr | Maj | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total |

| 2023 | -0.7 | 4.7 | 3.3 | -1.7 | 0.5 | 1.1 | -0.5 | 3.6 | 10.5 | ||||

| 2024 | 4.2 | 4.4 | 6.7 | 3.1 | 6.0 | -2.0 | 3.4 | -0.4 | 1.8 | 1.4 | 1.0 | 1.6 | 35.7 |

| 2025 | 3.8 | 4.0 | -5.2 | 0.3 | 3.8 | 1.8 | 8.6 |

The development is only indicative and depends on execution, slippage and brokerage.

Holdings and portfolio weights

Login required to view holdings.

Not a customer? Open an account to access our analytics service.

ℹ️ FACTOR-BASED STRATEGIES AND VALUE & MOMENTUM

A factor-based equity strategy systematically invests in stocks that exhibit certain characteristics – called factors – that have historically been associated with outperformance. Common examples include value, momentum, quality and low volatility.

The strategies are based on objective rules and data-driven analysis, not subjective judgments or gut feelings. This makes decision-making more consistent and less sensitive to market fluctuations. The portfolios are rebalanced regularly, often monthly, to adhere to the factors on which the strategy is based.

It is important to understand that factor strategies still invest in stocks and therefore have a high correlation with the stock market. They can therefore be expected to decline in value during broad market declines. Another risk is that factors can underperform for longer periods, which requires patience and discipline from the investor. The biggest risk is often not the model itself, but rather abandoning the strategy when things go wrong.

The Value & Momentum strategy combines two well-documented factors: low valuation and strong price momentum. The aim is to find stocks that are both fundamentally attractive and show a positive trend. The combination makes it possible to avoid so-called value traps – stocks that look cheap but continue to lose value.

Unlike a pure momentum strategy, which focuses solely on price gains and is often driven by a few big winners, Value & Momentum tends to provide a more even distribution of gains and losses. It reduces the reliance on individual extreme movements. At the same time, the strategy may miss some highly valued growth stocks with strong momentum that do not pass the value filter. Pure momentum often works best in strong bull markets with clear trends, while the combination of value and momentum tends to be more robust over time and in different market environments.

⚠️ RISK WARNING

Investing in financial markets always involves risk. Past performance is no guarantee of future results, and there is a possibility that you may lose all or part of your invested capital. Our analyses and indicators are based on historical data and statistical models, but these models cannot predict future market movements with complete certainty.

The value of investments may fluctuate significantly due to market conditions, company-specific factors and global economic events. It is important that you carefully consider your financial situation and your ability to bear potential losses before investing. The Service does not provide personal investment advice and recommends that you seek independent financial advice before making any investment decisions.

NeuroQuant employees may own or trade securities mentioned in analyses or based on indicators used in our services. This may potentially create conflicts of interest, but we strive for full transparency and professional integrity in all our activities. Following our analyses and indicators involves increased risk if the market moves in an unpredictable manner. You should only invest money that you are prepared to lose and understand that past performance, analyses or models provided through the service do not guarantee future results.