Get both actionable insights and clear signals for smarter investing

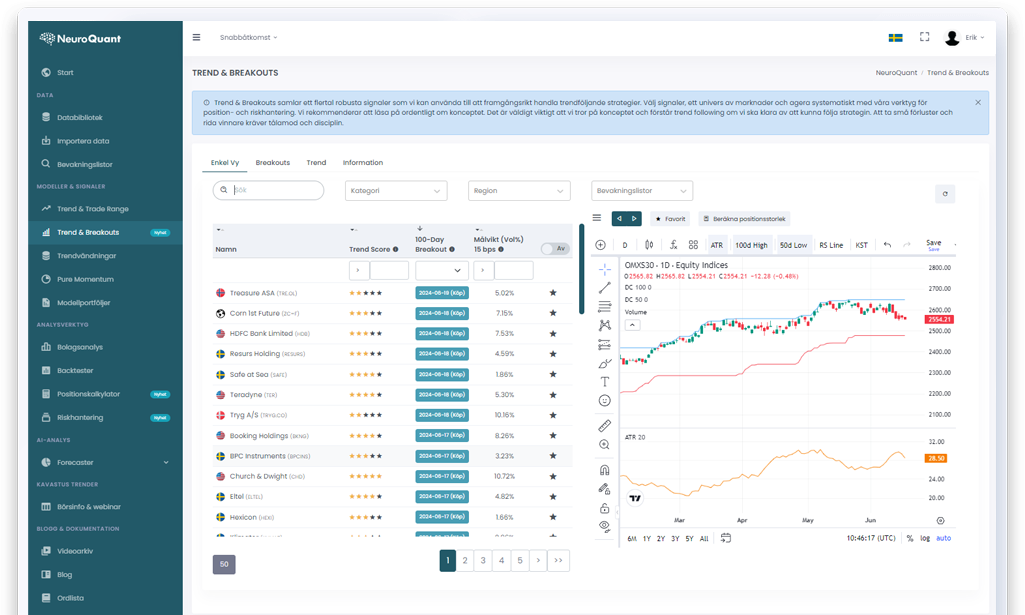

We combine in-depth analysis with clear, systematic signals to help you make informed investment decisions

- Analysis: Our in-depth analyses provide clear insights into market movements and the factors driving them. By analyzing trends, sectors and market behaviors, you can make more informed decisions and develop your own investment strategy.

- Signals: With our objective and concrete signals, you get clear indications of when it's time to act. Our signals built on robust, systematic strategies, eliminate emotional bias and uncertainty, allowing you to focus on key market opportunities.

Together, the analysis and signals give you both the understanding and tools you need to succeed as an investor. Whether you are a beginner or an experienced investor, our service offers a new and different way to make your investment decisions – without unnecessary noise.

Get the advantage that traditional investors miss – start today!