We offer smart model portfolios for long-term savings, adapted to different risk levels. Our strategies help you spread the risks, reduce fluctuations and at the same time increase the possibility of good returns. Keep in mind that historical returns do not guarantee future results, and our strategies are...

Read more

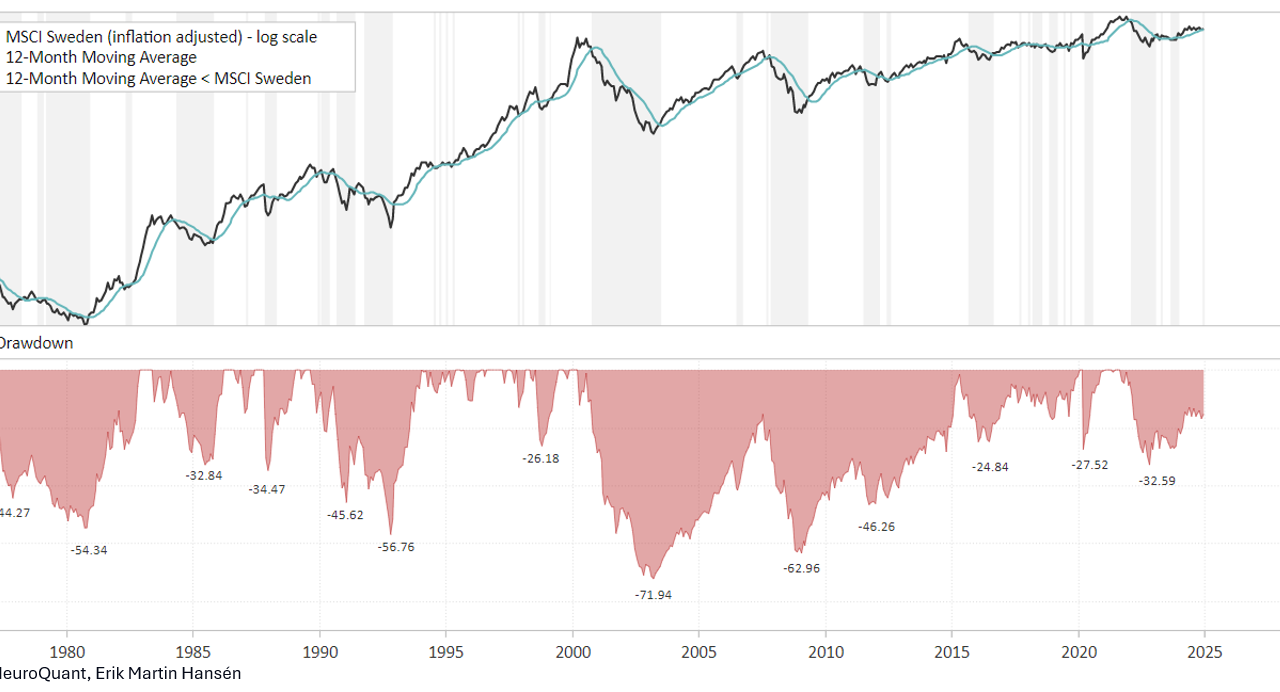

Bear markets, where the stock market falls by more than 20%, are an inevitable part of the investment cycle. They will always happen, making them predictable in the long run. However, timing them is notoriously difficult. Attempts at timing are...

Read more

In systematic trading, there is an ongoing debate about whether fast or slow signals are most effective. Both have their advantages and disadvantages, and the choice between them depends on one's strategy, market behavior, and risk management. In this post, we will...

Read more

The weekly report provides a clear and concise overview of the medium-term stock market outlook and the development of our systematic strategies, which are updated once a month. Focus on what matters most – no noise, just sharp and relevant information. In this edition: Stock market outlook...

Read more

Volatility & Quality is a factor-based strategy that aims to create exposure to stocks with low volatility and a high quality rating. Rebalancing occurs once a month and the goal is to achieve a higher risk-adjusted return than the stock market....

Read more

Investing shouldn't be like riding a roller coaster. For most private investors, the risk of making bad decisions in the wrong situations is one of the biggest obstacles to achieving their financial goals. Our new Multi Asset Strategy Global...

Read more

Lecture at Financial Stockholm by co-founder Erik Martin Hansén about thoughts and ideas about strategies and how we can use methods to capture winning stocks. Contents: Common thinking errors The reason to avoid subjective technical analysis How much the stock market usually falls...

Read more

Value & Momentum is a strategy that combines the factors of value and momentum to buy cheap companies that are trading with good momentum. Portfolio weights are adjusted for volatility and changes are made once a month. With patience, discipline and systematic position management...

Read more

The weekly report gives you a short and concise summary without getting caught up in unnecessary noise – all to keep you informed and well prepared. You also get an overview of the development of our systematic strategies. In this edition: Stock market outlook on...

2024: A typical year on the Stockholm Stock Exchange – Why it is important

Categories In Blog, Market comments Reading time - 4 min read

When we sum up 2024, we can see that the year so far has ended with an increase of 6% for the Stockholm Stock Exchange. Compared to historical data, this appears to be a stable and fairly typical year. But what does 6% actually mean in the context of previous...

Read more