On the platform, we offer portfolio weights adjusted for volatility to those of us who trade systematic strategies. This is very unique. With the help of these, we can regularly rebalance portfolios, which is one of the most important aspects for success when following a...

Read more

Dagens Industri called and asked questions about developments in the commodity market. Reporter Semir Hasanbegovic addressed longer cycles in the commodity market and how commodities tend to co-vary with stocks. We also talked about how to combine different asset classes to reduce the...

Read more

Top Picks Momentum buys and sells stocks based on our Pure Momentum strategy. This strategy identifies low-volatility uptrends, with the assumption that these trends often last longer than expected. While momentum strategies don't always perform optimally...

Read more

By studying market breadth, we get a clearer picture of the overall strength and health of the market. Instead of focusing solely on the total change in the index, we measure how many stocks within an index or market are participating in an up-...

Read more

Value & Momentum is a strategy that combines the factors of value and momentum to buy cheap companies that are trading with good momentum. Portfolio weights are adjusted for volatility and changes are made once a month. Holdings and position sizes are included in the premium package and...

Read more

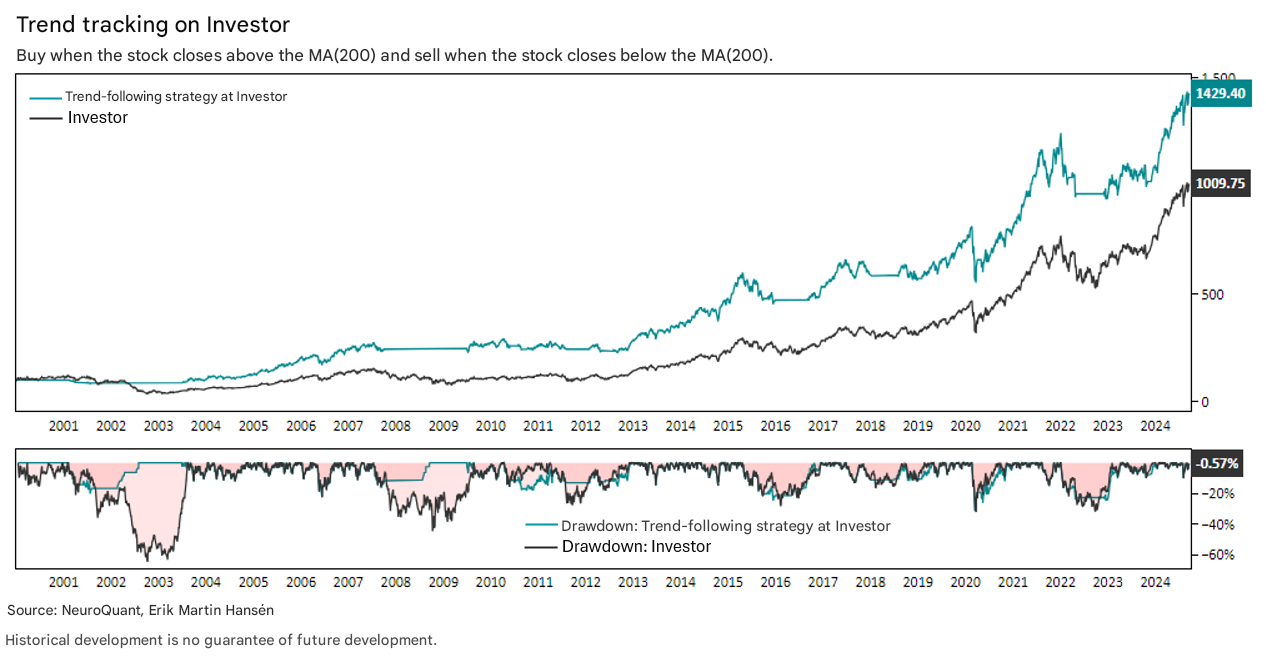

Trend following is about accepting small losses and riding winners. Riding winners longer than most others manage to do. As an investor, it is very easy to sell winners too early. The strategy works well when the market offers sustainable trends, but...

Read more

In the data library we have a wealth of price data and different types of indicators. Our breadth indicators show how the underlying stocks in an index are developing. These indicators can also be applied to commodities, currencies (FX) or interest rates. A breadth indicator provides an extra...

Read more

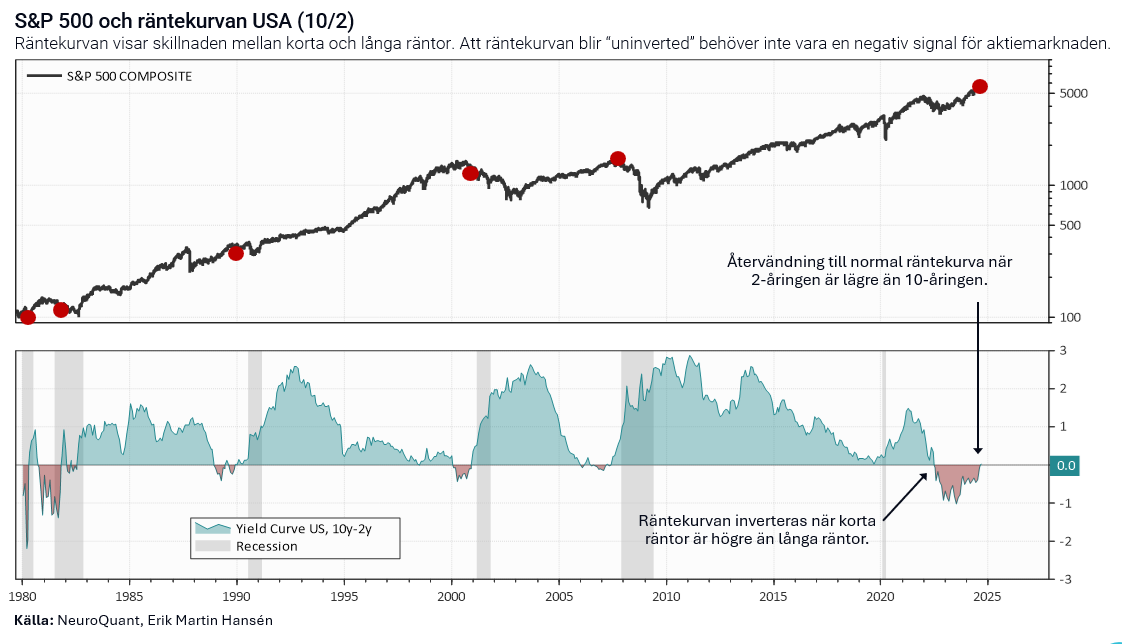

The US yield curve has now returned to a normal shape after being inverted since 2022. But what does this mean? When the yield curve inverts, it means that short-term interest rates are trading higher than long-term interest rates. Usually, it refers to the 2-year yield and...

Read more

Monday's Stock Market Lunch at EFN was hosted by our market strategist Erik Martin Hansén and David Bagge from Marketmate. We look at the Stockholm Stock Exchange, the New York Stock Exchange and gold, among other things. The hosts are Kelly Connelin and Gabriel Mellqvist.

Weekly report: Increased allocation in commodities

Categories In Blog, Market comments, Strategies Reading time - 2 min read

The weekly report contains signals from the noise. We summarize models and strategies, and try to decode the market's message with a scientific approach to stay on the right side of the larger trends. In this edition: Development portfolios/strategies Market commentary Development portfolios/strategies We present...

Read more