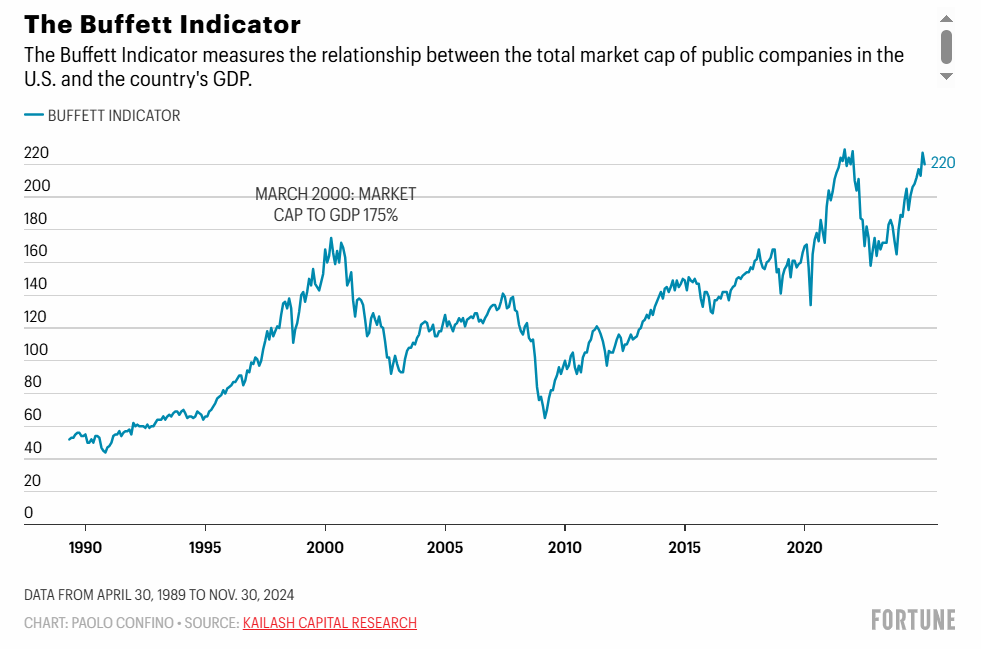

Some graphs get a lot of exposure – not because they’re particularly insightful, but because they look like they are. One such example is the classic market cap-to-GDP ratio, often called the Buffett indicator. It sounds...

Read more

S&P 500 har nyligen bildat ett så kallat “death cross” – när 50-dagars glidande medelvärde korsar under 200-dagars medelvärde. Detta tekniska mönster får ofta stor uppmärksamhet i media och tolkas som en varningssignal om en potentiell björnmarknad. Men historiska data...

Read more

Ibland dyker det upp grafer på sociala medier som får hundratals likes och delas flitigt. De ser förföriskt övertygande ut – med till synes perfekta samband mellan två variabler, ofta med exakt tidsförskjutning eller överlagrade mönster som passar nästan för...

Read more

Du har säkert hört det: ”Aktiemarknaden är dyr just nu” eller ”Nu är det köpläge – P/E-talet är lågt!” Det låter klokt. Och visst, värdering är ett viktigt verktyg för långsiktiga investerare. Men det är inte särskilt användbart om du försöker...

Read more

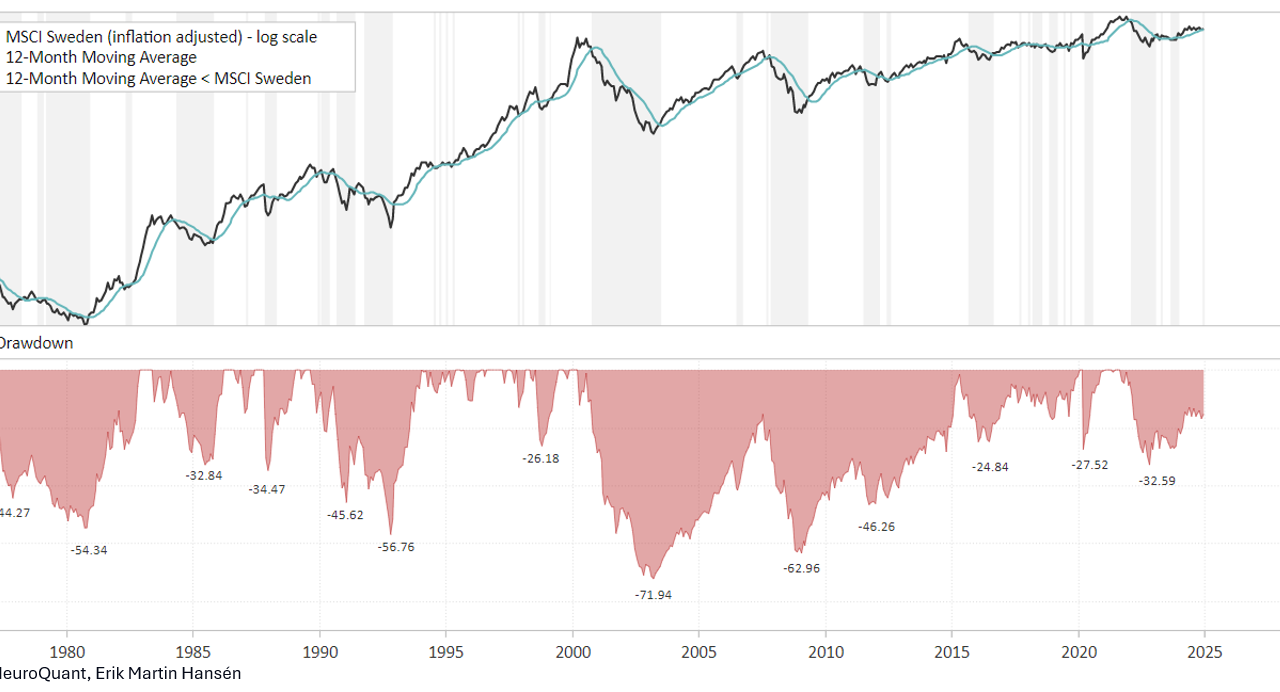

Bear markets, where the stock market falls by more than 20%, are an inevitable part of the investment cycle. They will always happen, making them predictable in the long run. However, timing them is notoriously difficult. Attempts at timing are...

Read more

S&P 500 har precis brutit ner under sitt 200-dagars glidande medelvärde (MA-200), en klassisk säljsignal som får många investerare att höja på ögonbrynen. Historiskt har detta setts som ett varningstecken för svagare börsutveckling. Men hur pålitlig är egentligen denna signal?...

Read more

Many investors look for patterns that can help them understand the movements of the stock market. One of the more talked about phenomena is seasonal cycles – recurring patterns that have historically been shown to influence the market. But just like with any other factor, there are...

Read more

Bear markets, where the stock market falls by more than 20%, are an inevitable part of the investment cycle. They will always happen, making them predictable in the long run. However, timing them is notoriously difficult. Attempts at timing are...

Read more

Lecture at Financial Stockholm by co-founder Erik Martin Hansén about thoughts and ideas about strategies and how we can use methods to capture winning stocks. Contents: Common thinking errors The reason to avoid subjective technical analysis How much the stock market usually falls...

Read more

Investors have long been fascinated by the idea of predicting which companies will deliver strong future earnings. It makes sense: if you can predict future earnings, it should be easy to beat the market. But what if I told you that...