Many private investors make the mistake of listening too much to what famous investors say about the stock market or the economy. Of course, that sounds reasonable. If someone who has built a billion-dollar empire says the market is going to fall, why not take it seriously? The problem is...

Read more

Vi människor älskar citat. Korta, slagkraftiga meningar som känns kloka och trygga. På börsen är de extra populära – de ger en känsla av förståelse i en värld som annars präglas av osäkerhet, brus och motsägelser. Men problemet är att...

Read more

Bear markets, where the stock market falls by more than 20%, are an inevitable part of the investment cycle. They will always happen, making them predictable in the long run. However, timing them is notoriously difficult. Attempts at timing are...

Read more

Om du någonsin har upplevt att en förlust på aktiemarknaden känns som ett hugg i magen, men en lika stor vinst bara ger en axelryckning, så är du inte ensam. Detta fenomen kallas loss aversion (förlustaversion), och det är en...

Read more

One of the indicators I study to quantify investor sentiment is the survey from AAII (American Association of Individual Investors). They ask how private investors feel about the stock market over the next 6 months. AAII can be seen as the American equivalent of Aktiespararna, but...

Read more

Bear markets, where the stock market falls by more than 20%, are an inevitable part of the investment cycle. They will always happen, making them predictable in the long run. However, timing them is notoriously difficult. Attempts at timing are...

Read more

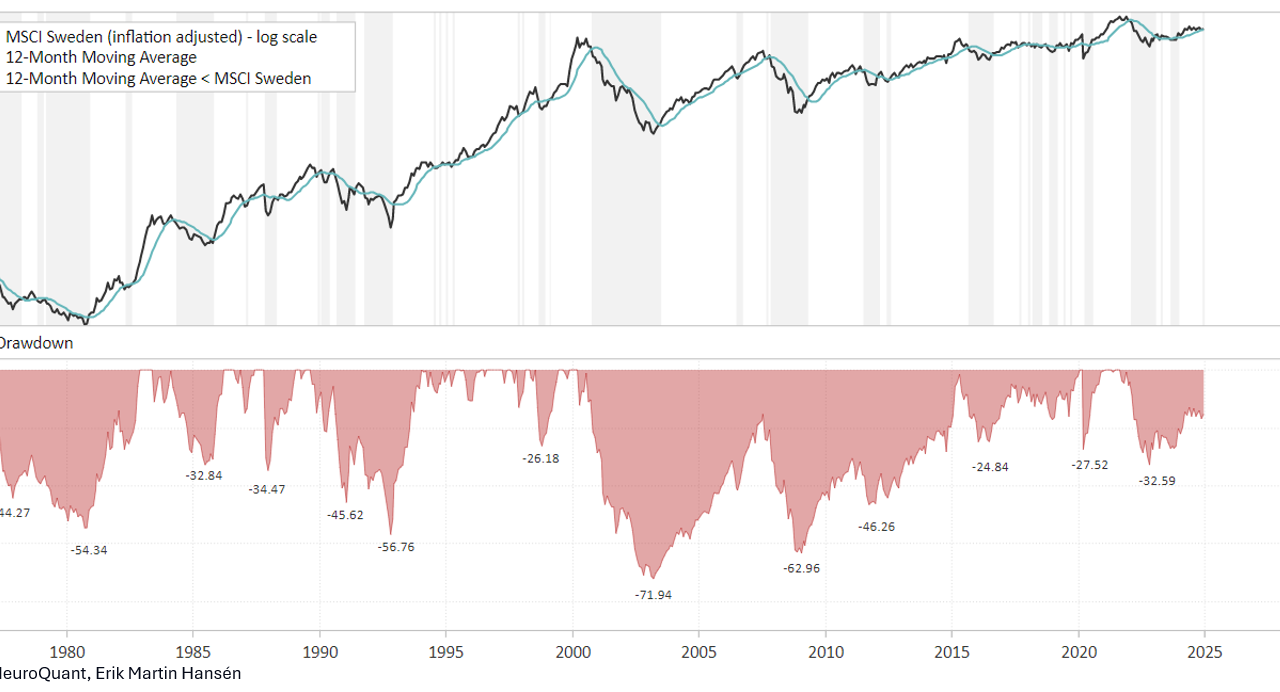

Lecture at Financial Stockholm by co-founder Erik Martin Hansén about thoughts and ideas about strategies and how we can use methods to capture winning stocks. Contents: Common thinking errors The reason to avoid subjective technical analysis How much the stock market usually falls...

Read more

According to Prospect Theory, developed by Kahneman and Tversky, we humans are emotionally affected by losses more than by gains. This leads to us holding on to losing stocks for too long in the hope that they will recover...

Read more

Investors have long been fascinated by the idea of predicting which companies will deliver strong future earnings. It makes sense: if you can predict future earnings, it should be easy to beat the market. But what if I told you that...

Read more

Technical analysis is very popular and often the first method that beginners encounter when they start trading actively, especially if they focus on short-term trading. With simple graphs and clear patterns, technical analysis seems to promise quick results and easy...