ETFs based on covered call strategy

Broker Montrose has launched “Montrose Global Monthly Dividend MSCI World UCITS ETF”, Sweden's first exchange-traded fund with monthly dividends. This ETF combines global diversification through exposure to the MSCI World Index with a covered call strategy to generate higher returns. How does the strategy work and what should you consider?

The ETF replicates the MSCI World Index and uses a covered call strategy. In addition to equity holdings, funds sell call options on their holdings, generating premium income. This income contributes to the monthly dividend but can also limit the potential for price increases above a certain level.

- Monthly dividend: The ETF aims to provide an annual dividend yield of approximately 6%, equivalent to 0.5% per month. Dividends come from both the companies' ordinary dividends and premium income from the options strategy.

- Trade and currency: The ETF is listed in Sweden and traded in Swedish kronor (SEK), eliminating the need for currency exchange for Swedish investors.

American equivalents

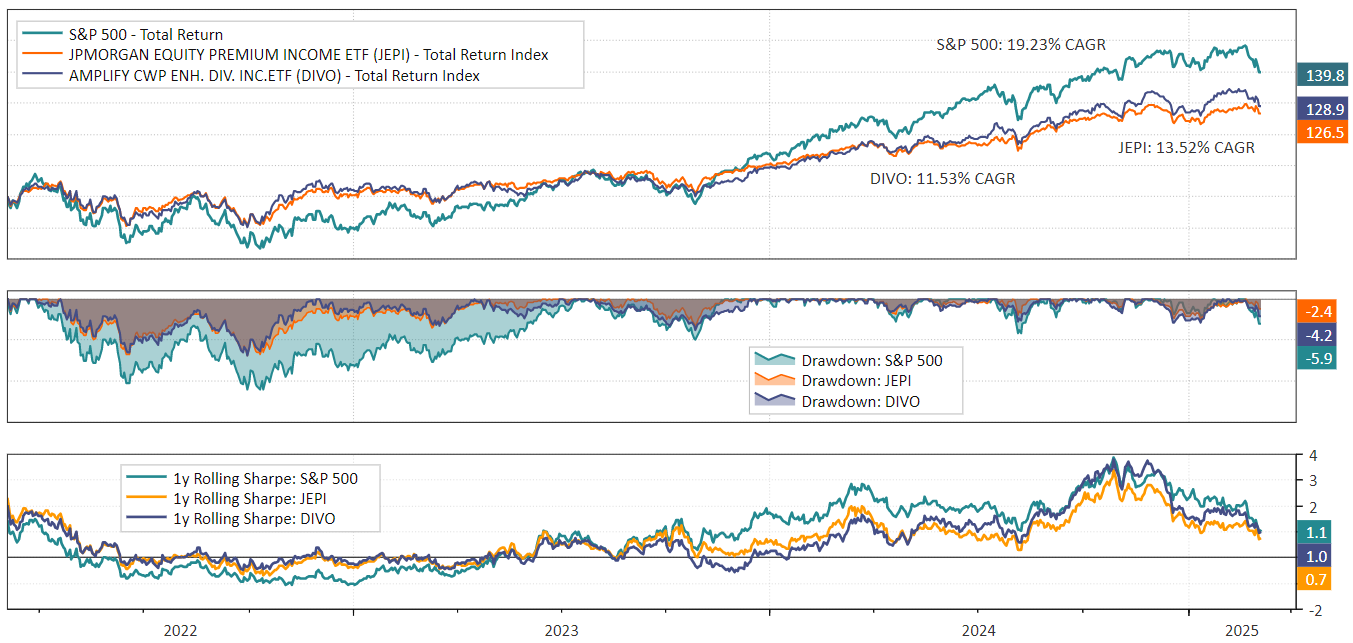

Here we see a graph of the development of some corresponding US ETFs. The development includes the dividends paid. In 2022, the decline was less than the S&P 500, but in an upward market these ETFs will not develop as strongly as the index.

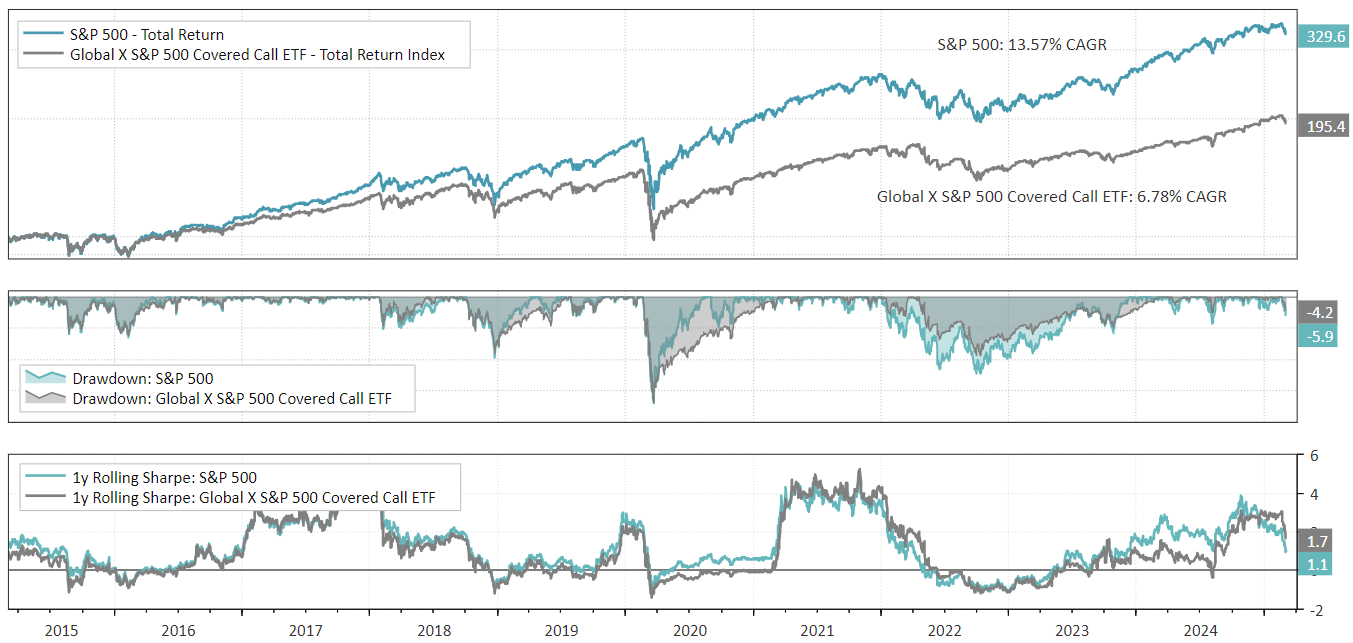

And here we see the development for an ETF with a slightly longer history.

Why so popular despite weaker total returns?

ETFs with a covered call strategy have become popular among “dividend hunters.” Here are some of the main reasons why they have become popular:

- High and regular dividends – Many of these ETFs pay monthly dividends, which is attractive to investors who want a stable source of cash flow.

- Lower volatility – By selling call options, the ETF receives premium income, which can cushion downturns and create a more consistent return than traditional stock indexes.

- Good in sideways market – The strategy works best when the market is moving sideways or slowly upwards, as premium income adds to the return.

- Alternatives to bonds – With interest rates low, many investors have been looking for new sources of income. Covered call ETFs often offer a higher yield than fixed income assets.

- Simple exposure to a complex strategy – Instead of selling call options themselves, investors can get the same strategy via an ETF, making it easily accessible even for beginners.

But think about:

- Limited upside – If the market rises sharply, the return can be much lower than for regular stock ETFs because the options put a cap on the profit.

- Not optimal in a bull market – When the stock market is surging, covered call ETFs can lag significantly behind the index.

In summary, covered call ETFs are popular with investors who chase dividends and prioritize stable income streams. It is not a strategy for investors who intend to maximize returns.