How to build a winning small-cap portfolio

Did you miss Friday's Market Pulse about how we can build a small-cap portfolio? If so, you can read this blog post or watch the replay of the video.

Small companies attract many investors – and rightly so. They tend to grow faster, are more affected by news and can provide high returns when everything falls into place. But they also come with their own challenges: lower liquidity, higher volatility and greater differences in quality. That’s why we need to approach small companies with structure and thought.

In this post, we will go over how we develop a small-cap ranking that will form the basis for building a systematic and well-balanced small-cap portfolio. We will show you how you can combine price data (momentum and trend quality) with fundamental factors (earnings and quality) and why liquidity is extra important in this part of the market.

To manage the higher volatility that often accompanies small-cap stocks, we use our volatility-adjusted portfolio weights. This means that more stable companies receive a greater weight in the portfolio, while more volatile stocks receive a lower weight – without us having to make subjective judgments.

The goal? To create a portfolio of small companies that:

- Has a strong and gradual upward trend

- Shows fundamental support in profit and quality

- Has sufficient liquidity to actually be traded

- Is balanced by risk – not gut feeling

Follow along and we'll show you how you can do the same thing - step by step.

Liquidity – crucial when investing in small companies

One of the most common mistakes when building a small-cap portfolio is to ignore the liquidity of the stocks you choose. Just because a company looks cheap, has strong numbers, or has risen sharply recently doesn't mean it's a good investment case – at least not if you can't buy and sell the stock without any problems.

In small companies, liquidity is often lower than in large companies, which means that:

- The spread (the difference between the bid and ask price) is higher

- It can be difficult to enter or exit a position without affecting the price

- You can get stuck in a stock in the event of bad news or a weaker stock market climate.

It is therefore important to set a minimum liquidity requirement, so that you only invest in stocks that you can actually trade in practice – not just in theory.

What fundamental ratings should we use in our rankings?

When we build a small-cap portfolio, we can combine price trends with the fact that the companies have support in foundations. Some companies temporarily rush on hopes or news feeds, but lack long-term sustainability. By combining our technical measures with fundamental grades We filter out the most speculative stocks and increase the likelihood of capturing companies with real strength.

We weed out the weakest companies but let price (momentum + trend quality) determine which stocks enter the portfolio.

It follows the classic principle: “Rank on what works. Filter out what's broken.”

Here are our most important fundamental ratings – and how we use them:

Profit rating – extra important for small businesses

This rating reflects how sustainable the earnings trend is. In small companies, we want to avoid temporary gains that come from one-offs or creative accounting. A weak earnings rating is often a red flag.

Therefore, we use the Win Rating as a filter.

Quality rating – at least equally important

This rating summarizes the company's profitability, debt and financial stability. We don't want a strong price trend to lure us into companies with an underlying weak balance sheet.

Here too, we use the rating as a filter – not to identify top companies, but to avoid the most vulnerable ones.

Rating – less important

Small companies can often look expensive on the surface – but that can be justified if growth is strong. The point here is not to weed out future winners just because the multiples are high right now. That's why we don't use Valuation for this ranking. But we could filter out the very most extremely valued companies without favoring low valuations.

Risk rating – not included in the ranking, but sometimes as a filter

All small companies fluctuate more than large companies – that's natural. We therefore do not use Risk Score in the ranking itself, but it can act as an extra filter to avoid the most extreme movements.

How we create the rankings

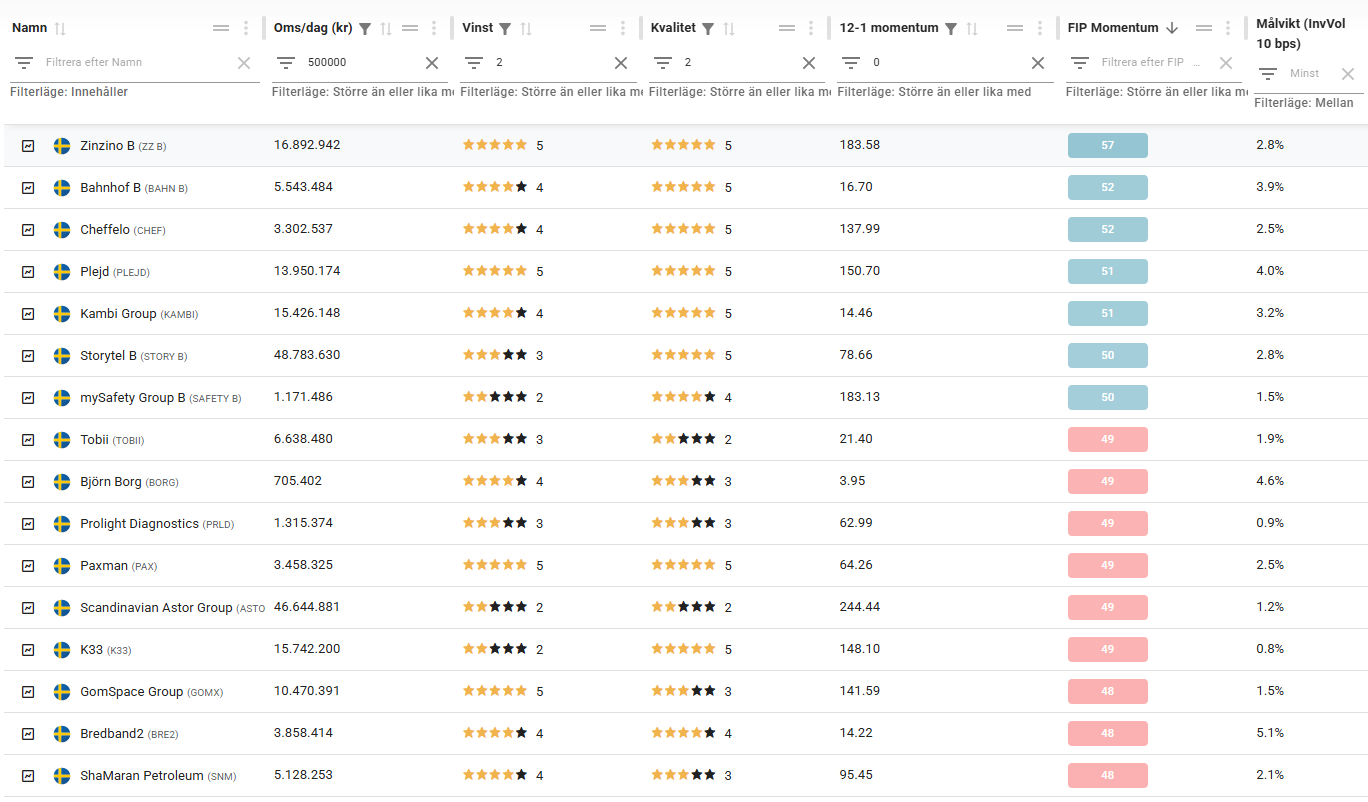

Now let's create a ranking based on liquidity, fundamentals, and price trend.

- Average daily turnover > SEK 500,000

- Quality rating > 2

- Profit rating > 2

- 12-1 momentum > 0 or trend rating above 4

- Sort by FIP (quality of trend)

When we combine price strength, trend quality and fundamental filters, we get a specific type of small cap – companies that:

- Trade in stable upward trends

- Has proven profit development and certain financial quality

- Doesn't necessarily get the most attention in the media or on forums

- Has sufficient liquidity to actually be traded

- Has momentum that is still intact, but without being overly straight-forward

Go to the page Factor rating under Company Analysis to create the ranking.

Shouldn't we use more gut feeling in small companies?

One advantage of ranking in this way, rather than reading each report by hand, is that data-driven ratings weigh profitability, cash flow, debt, and stability together. This is often better than subjective interpretations, especially over time.

By prioritizing quality over price trends, we eliminate much of what otherwise requires gut feeling to handle.

| Misunderstanding | But objective ranking solves it like this: |

| “You have to read each report yourself” | Profit and quality scores already weigh in on the central |

| “Small companies are so different, you have to understand the case” | Using the same criteria creates comparability |

| “You have to understand the management and the story” | FIP + stable profit = higher probability that the story will hold up |

| “There is too much noise in small companies” | Trend and fundamental filters greatly reduce noise |

How we weight the portfolio with regard to volatility

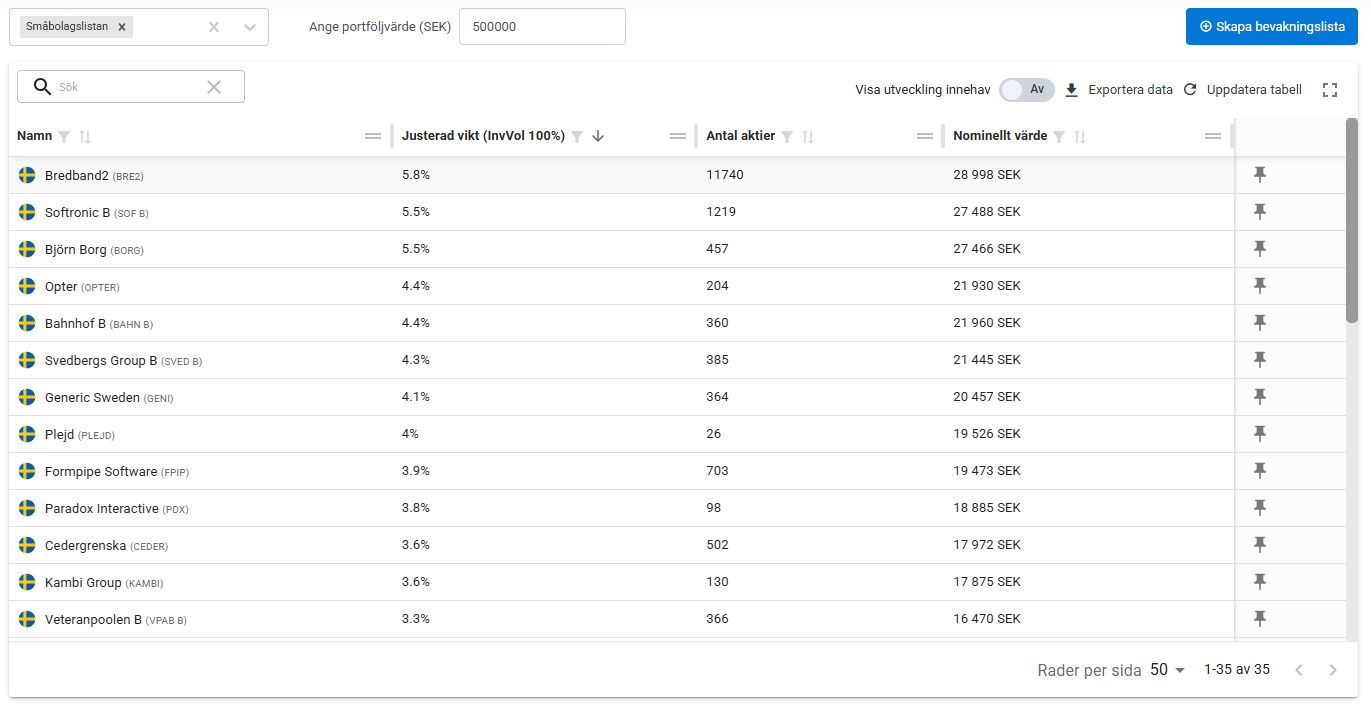

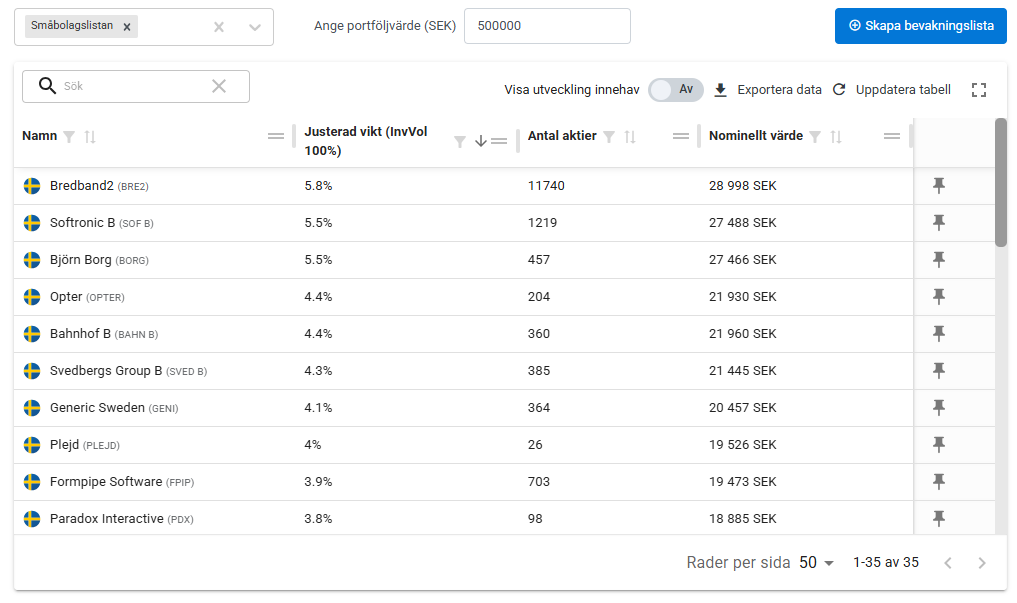

Once we have selected our small-cap stocks based on price trend, fundamentals, and liquidity, one important question remains: How much of each stock should we buy?

Small caps vary greatly in how much they fluctuate. Some move calmly in a clear trend, while others jump 10% on a news story or for no reason at all. To create a more balanced and robust portfolio, we use volatility-adjusted portfolio weights.

In practice, this means that:

- Stable stocks gain more weight

- Volatile stocks get less weight

By taking historical volatility into account in the weighting, we avoid guessing and get a more risk-adjusted distribution, without having to try to predict the future.

Here is an example from the Portfolio Weights page, where you can easily select your small cap watchlist, enter your portfolio value, and see how many shares you should buy in each company.

Conclusion: Systematics in a noisy world

Investing in small companies is exciting – but also challenging. That's why we need a framework that prevents us from getting carried away by emotions, forum threads or gut feelings.

With a systematic approach we can:

- Filter out the noise and find companies with both trend and substance

- Avoid the most illiquid stocks that can be expensive to trade

- Weight the portfolio so that the risk is more evenly distributed

It's not magic. It's math, structure, and patience. You don't have to find the next rocket. You just need to have a robust process that consistently picks out the companies most likely to perform.

Would you like to try building your own small-cap portfolio with our platform? The filters and ratings are already in place – just get started.