Market Pulse: How to build a small-cap portfolio

On Fridays we end the week with stock talk and updates and information about our stock strategies. We talk about stocks that qualify for our strategies and explain why. Everything is based on objective signals, clear criteria and a systematic selection. For those who want to see how our methods work in practice.

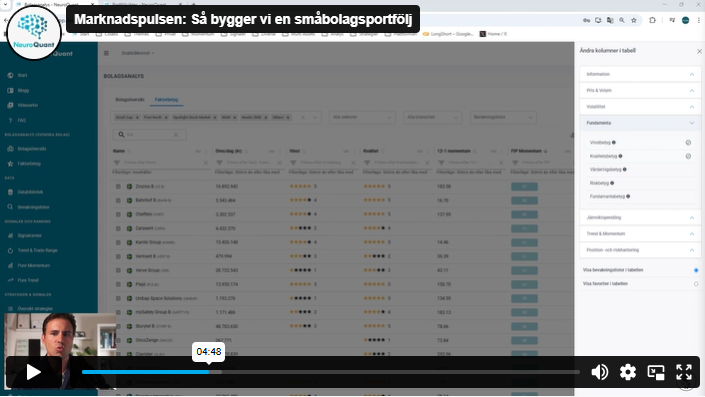

We do not have any strategies or stock portfolios focused solely on small caps, and we exclude the smaller lists from our strategies. But today we will go through how we develop a small cap ranking that will be the basis for building a systematic and well-balanced small cap portfolio. We will show you how you can combine price data (momentum and trend quality) with fundamental factors (earnings and quality) – and why liquidity is extra important in this part of the market.

Content:

- Liquidity – crucial when investing in small companies

- What fundamental ratings should we use in our rankings?

- How we create the rankings

- Isn't more gut feeling needed in small companies?

- Conclusion: Systematics in a noisy world

Login required to access our analysis.

Not a customer? Open an account to access our analytics service.