Monthly Update: Investment Strategies (ETF Portfolios)

We offer smart model portfolios for long-term savings, adapted to different risk levels. Our strategies help you spread your risks, reduce fluctuations and at the same time increase the possibility of good returns. Keep in mind that historical returns do not guarantee future results, and our strategies are for inspiration – not personal advice.

Our all-weather portfolios offer broad, constant exposure to the market – a pure beta solution. Our active and dynamic strategies, on the other hand, are designed to create alpha by actively adapting and focusing on the most promising trends.

Content

- Development of global markets

- All-weather portfolios

- Dynamic/active portfolios

- Changes in portfolios

- Information about currency effects

1. Development of global markets

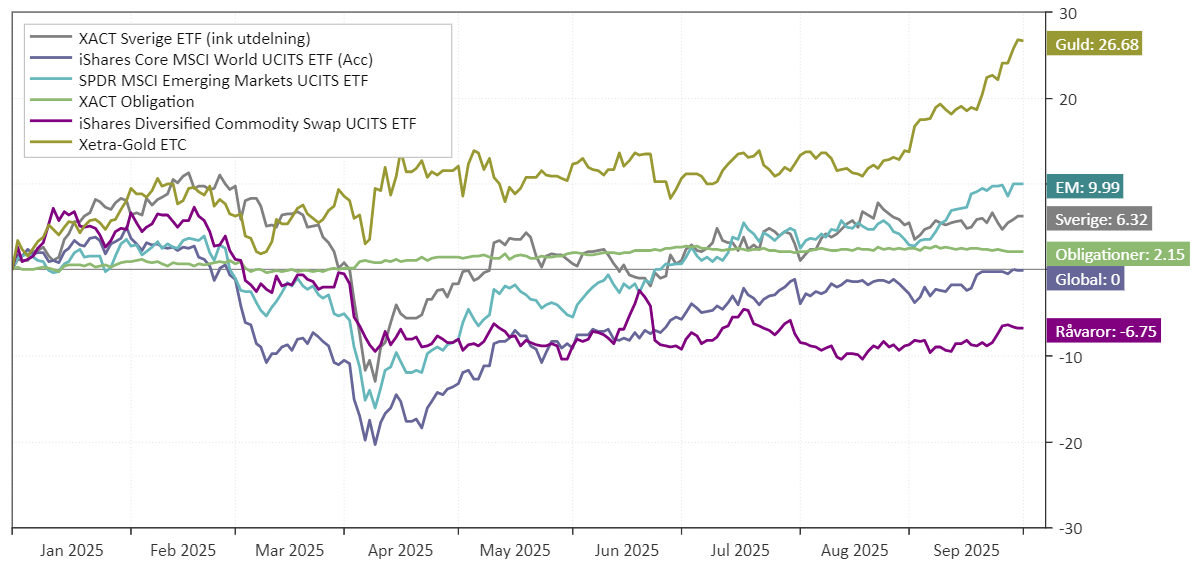

Global markets have recovered since the bottom in April, but so far this year the trends have been weak, and diversification into commodities or fixed income securities has not provided a major boost.

Keep in mind that diversifying outside of stocks can be both rewarding and sometimes frustrating, depending on the market.

Development Year to Date, SEK (rebase 100)

Login required to access the full publication.

Not a customer? Open an account to access our analytics service.

❓ FREQUENTLY ASKED QUESTIONS

What is an ETF, and why do you use them in your portfolios?

An ETF (exchange-traded fund) is a cost-effective way to gain exposure to different assets, regions or themes. We use ETFs to build diversified portfolios that are easy to trade and track.

Can I replace the holding with a similar ETF?

Yes, it usually works out fine – especially if the ETF you choose has a similar exposure and focus. Make sure it reflects the same asset class, region or sector, and that it has reasonable fees and liquidity. Small deviations may occur, but the overall strategy is usually affected very little.

How much of my capital should I invest in a strategy?

It depends on your risk profile. An all-weather portfolio can serve as a safe base, while a dynamic strategy can complement as an offensive part. Many choose to combine a cautious and a more growth-oriented strategy to balance risk and potential.

Should I choose a passive all-weather portfolio or an active dynamic strategy?

It depends on your goals. An all-weather portfolio is suitable for those who want stability, a broad spread of risk and low maintenance. A dynamic strategy is suitable for those who seek higher returns, can handle variations and want to follow the market's strongest trends.

How often are the portfolios updated?

The portfolios for the dynamic strategies – Global Trend, Global Momentum and Dynamic Sector Allocation – are updated at the beginning of each month. The all-weather portfolios have fixed holdings and are rebalanced twice a year.

How do I know which strategy is right for me?

Consider your time horizon, your risk tolerance and how active you want to be. Do you want calm and stable development? Choose an all-weather portfolio. Do you want to maximize returns through trend strength? Take a look at our dynamic strategies. Do you want both? Combine.

Do leverage strategies work?

Yes, but leverage increases both ups and downs. For stable all-weather portfolios, low leverage can be reasonable. For dynamic strategies, greater caution is required because they are already offensive. Only use leverage if you understand the risks and have a long-term plan.

How should you think about currency effects when investing in ETFs?

When you invest in ETFs that are traded in currencies other than Swedish kronor, such as euros, the return is affected by the exchange rate. A stronger krona can reduce the return, while a weaker krona can increase it – even if the ETF itself is unchanged. We use both euro and SEK-listed ETFs, but the supply in SEK is limited. Therefore, euro ETFs often provide better access to broad and cost-effective investments. Our backtests are often based on US ETFs with a longer history, which can create some difference to actual development – but in the long term, currency effects tend to even out.