Monthly Update: Top Picks Momentum

The Top Picks Momentum equity portfolio is based on a variation of our Pure Momentum strategy. The strategy identifies low-volatility stocks in clear uptrends, with a medium-term lookback period. The underlying assumption is that these trends often last longer than many expect.

A characteristic of momentum strategies is that a few big winners often account for a large part of the total return. The strategy therefore aims to follow these winners while avoiding the bigger losers. However, momentum is difficult for many to follow in practice, and requires clear and structured rules to be able to benefit from its potential.

The strategy does not take into account company fundamentals and is entirely price-based, which may feel unfamiliar to investors who prefer storytelling. It is designed to take advantage of the well-documented momentum effect and includes both built-in risk management and an objective method for determining position sizes.

Click here to read more about our systematic stock strategies and stock portfolios.

Information

- Direction: Long-only (no short positions)

- Strategic direction: Price momentum adjusted for volatility

- Investment universe: Sweden (also Nordic)

- Portfolio weights: Volatility-adjusted

- Rebalancing frequency: Monthly

Development

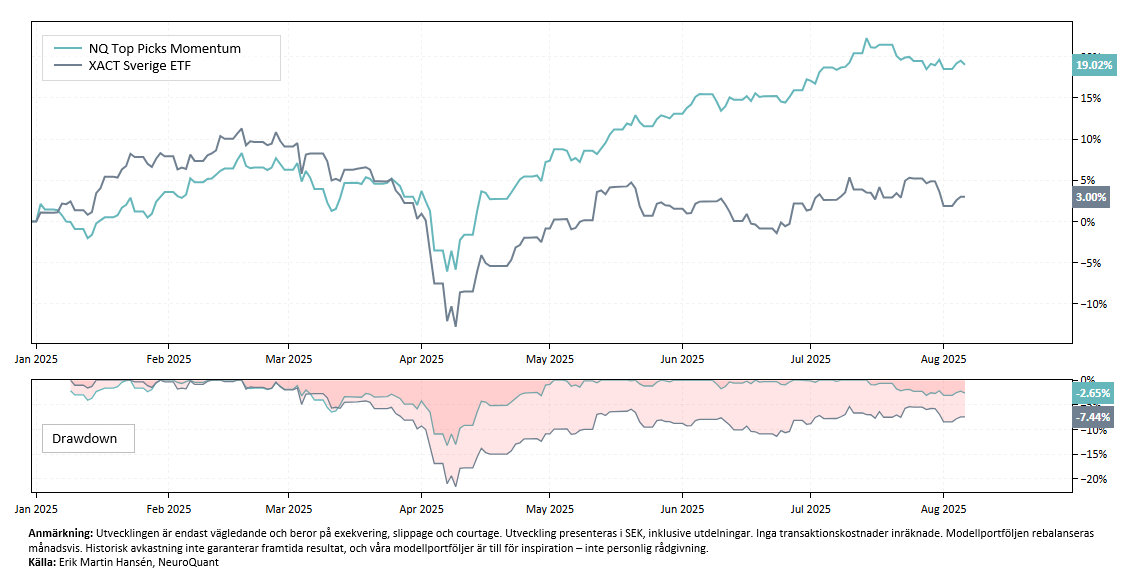

In 2025, Top Picks Momentum has risen by 19%, compared to the Stockholm Stock Exchange's rise of around 3%. In professional contexts – such as fund management, institutional investors and academic studies – it is understood that risk-adjusted returns are compared, i.e. how much return you have received per unit of risk compared to the index. Simply beating the index in absolute returns does not in itself say much about the quality of the strategy.

The portfolio's Sharpe ratio has been 2.1 in 2025, compared to the Stockholm Stock Exchange's 0.12. Since the start of 2023, the Sharpe ratio has been 1.3, compared to the stock exchange's 0.7.

Over the past month, the biggest contributors have been Tele2, Protector Forsikring and Gjensidige Forsikring. The biggest headwinds came from Zenith Energy, Kongsberg Gruppen and Addlife. Zenith Energy fell by a whopping 75%, but thanks to volatility-adjusted portfolio weights and good diversification, the impact on the portfolio was only around 1%.

Monthly development (%)*

| Year | Jan | Feb | Mar | Apr | Maj | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total |

| 2023 | 8,8 | 1,3 | 1,4 | -0,4 | -0,6 | 2,1 | -2,1 | -4,4 | -2,7 | -0,2 | 0,5 | 3,7 | 7,0 |

| 2024 | 5,0 | 3,6 | 5,1 | -0,7 | 7,6 | -0,3 | 0,8 | -2,7 | 0,4 | -0,2 | -0,1 | 0,7 | 20,4 |

| 2025 | 3,6 | 2,6 | -4,0 | 5,1 | 5,5 | 3,7 | 2,0 | -0,5 | 19,0 |

*The development is indicative only and depends on execution, slippage and brokerage.

Holdings and portfolio weights

Holdings and portfolio weights in our factor-based equity strategies are included in the premium package and are available on the page Model portfolios.

Login required to view holdings.

Not a customer? Open an account to follow our stock portfolios.

ℹ️ FACTOR-BASED STRATEGIES AND TOP PICKS MOMENTUM

The Top Picks Momentum model portfolio is based on a variant of our Pure Momentum model with objective and transparent rules – without gut feelings or subjective interpretations. The focus is on stable momentum combined with consistent risk management. The aim is to create clear decision-making and a disciplined investment process – free from emotional mistakes.

In exceptional cases, we may make discretionary decisions to buy or exit, such as in the event of new issues, delistings, parabolic runs or other unusual events. Such decisions are rare and do not affect the foundation of the strategy – which is based on following the principles of Pure Momentum rather than “stock picking”.

We help investors make better decisions by offering structured methods with proven historical strength, rather than trying to predict the market’s next move. Momentum is one of the most robust anomalies in financial markets – unlike many other factors that appear and quickly disappear. But even the best strategy can fail if it is not followed.

Common mistakes include exiting positions too early, chasing overheated trends, ignoring exit signals, or taking too large positions. Many people allow themselves to be swayed by short-term volatility, lack of patience, and emotional decisions – which often undermines the long-term profitability of the strategy.

Discipline and risk management are crucial to success.

⚠️ RISK WARNING

Investing in financial markets always involves risk. Past performance is no guarantee of future results, and there is a possibility that you may lose all or part of your invested capital. Our analyses and indicators are based on historical data and statistical models, but these models cannot predict future market movements with complete certainty.

The value of investments may fluctuate significantly due to market conditions, company-specific factors and global economic events. It is important that you carefully consider your financial situation and your ability to bear potential losses before investing. The Service does not provide personal investment advice and recommends that you seek independent financial advice before making any investment decisions.

NeuroQuant employees may own or trade securities mentioned in analyses or based on indicators used in our services. This may potentially create conflicts of interest, but we strive for full transparency and professional integrity in all our activities. Following our analyses and indicators involves increased risk if the market moves in an unpredictable manner. You should only invest money that you are prepared to lose and understand that past performance, analyses or models provided through the service do not guarantee future results.