Monthly Update: Volatility & Quality

Volatility & Quality is a factor-based equity portfolio that aims to create exposure to stocks with low volatility and a high quality rating. Rebalancing occurs once a month and the goal is to achieve a higher risk-adjusted return than the stock market.

All of our factor-based strategies are based on concepts where there are behavioral explanations for why they have the potential to outperform. These strategies help us act more rationally. By following a systematic strategy, we avoid the mistake of selling winning positions too early, for example.

Our stock portfolios are included in our premium package and are updated once a month.

Information

- Direction: Long-only (no short positions)

- Strategic direction: Quality, volatility and trend

- Investment universe: Nordic countries & USA

- Portfolio weights: Equally weighted (capital/number of positions)

- Rebalancing frequency: Monthly

Development

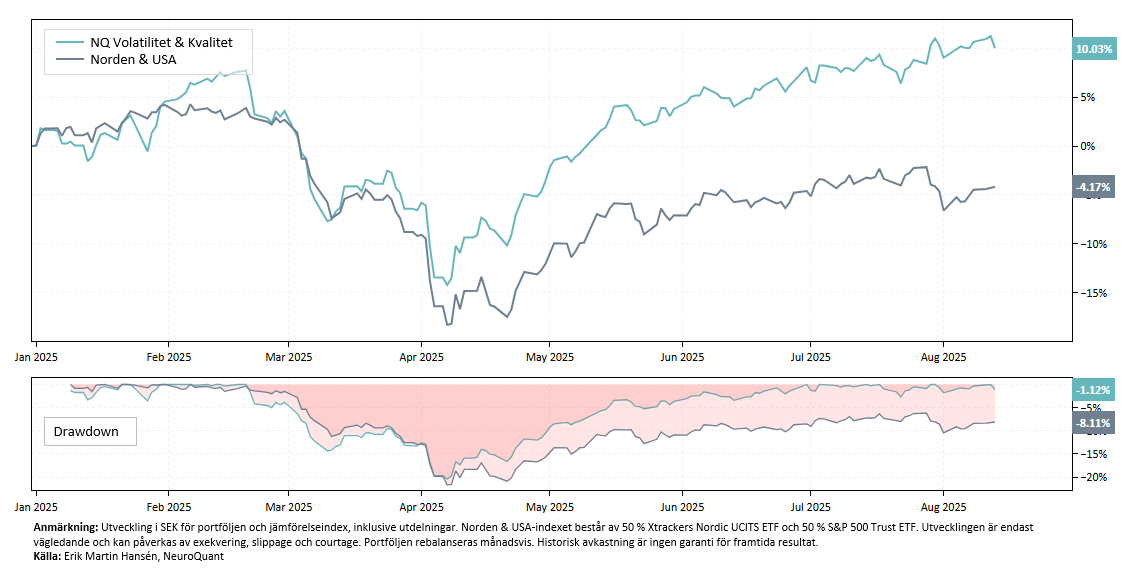

In 2025, the portfolio has risen by 10.0%, which is lower than the performance of the Top Picks Momentum and Value & Momentum portfolios, but higher than the performance of the Stockholm Stock Exchange, both risk-adjusted and in absolute terms. The benchmark index with 50% US and 50% Nordics has fallen by 4% in 2025.

Calculated in USD, the portfolio has risen by 27.5%, which shows that the stronger krona has eaten up a large part of the return. For Swedish investors, this has therefore been a negative currency effect.

Trying to time currency movements is very difficult, and in the short term they can provide “noise” that hides the underlying development of companies. In the longer term, exchange rates are often more cyclical. Periods of krona strengthening are often followed by weakening and vice versa.

Last month, Celestica Inc., Palantir Technologies and Hoist Finance have been top contributors to the portfolio.

Since the start of April 2023, the portfolio has returned 48.7%, compared to the Stockholm Stock Exchange's 29.5%. The Sharpe ratio has been 1.2 compared to 0.6 for the Stockholm Stock Exchange. Volatility has been 11.8% and tracking error against the Stockholm Stock Exchange is 12.5%. Note that the portfolio changed its universe for 2025 and currently allocates 50% of its capital to the US.

Monthly development (%)*

| Year | Jan | Feb | Mar | Apr | Maj | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total |

| 2023 | 1,2 | 3,0 | 1,0 | 0,8 | -0,7 | -1,8 | 1,2 | -2,2 | 2,2 | 4,6 | |||

| 2024 | 5,6 | 3,4 | 5,7 | 3,0 | 6,6 | 0,2 | 3,3 | 0,1 | -0,2 | -3,5 | 1,3 | 0,9 | 29,1 |

| 2025 | 4,6 | -0,9 | -9,8 | 3,3 | 7,6 | 4,1 | 2,0 | -0,2 | 10,0 |

*Performance is indicative only and depends on execution, slippage and brokerage. Our performance is based on 30 equally weighted holdings, but you can of course use our volatility-adjusted portfolio weights on the page Portfolio weights.

Changes in holdings

Login is required to access our stock portfolios.

Not a customer? Open an account to access our analytics service.

❓ FREQUENTLY ASKED QUESTIONS

What is the difference between your stock portfolios and stock strategies?

A stock portfolio is a model portfolio – such as Top Picks Momentum, Value & Momentum or Volatility & Quality – where we report holdings, changes and development over time. A stock strategy is a set of rules for buying and selling, together with methods for risk and position management. Our strategy signals on the platform can be used to manage a portfolio yourself according to these rules.

Where can I find holdings and portfolio weights?

You can find our holdings and weights on the page Model portfoliosYou can also filter model portfolios via watchlists on several pages in the platform.

Is it possible to replicate a stock portfolio 100%?

It is possible to replicate the portfolios if all changes and rebalancing are carried out according to our updates. However, some deviations may occur because buy and sell transactions are made at different rates, and transaction costs in the form of brokerage, exchange fees and slippage are added. Please note that historical performance is never a guarantee of future results. Our portfolios are intended as inspiration, not as personal investment advice.

How often are the portfolios updated?

Our equity portfolios are updated approximately once a month. The rebalancing frequency is a trade-off between several factors – such as transaction costs, administration and the need to rebalance the portfolio. For the portfolios we offer today, monthly rebalancing has proven to work well.

Do you use stop unloaders?

No, we do not use traditional stop loss levels in our equity portfolios. If a holding falls out of the ranking during the monthly rebalancing, it is sold, but this happens as part of the systematic process – not because of a specific price level.

ℹ️ FACTOR-BASED STRATEGIES

A factor-based equity strategy systematically invests in stocks that exhibit certain characteristics – called factors – that have historically been associated with outperformance. Common examples include value, momentum, quality and low volatility.

The strategies are based on objective rules and data-driven analysis, not subjective judgments or gut feelings. This makes decision-making more consistent and less sensitive to market fluctuations. The portfolios are rebalanced regularly, often monthly, to adhere to the factors on which the strategy is based.

It is important to understand that factor strategies still invest in stocks and therefore have a high correlation with the stock market. They can therefore be expected to decline in value during broad market declines. Another risk is that factors can underperform for longer periods, which requires patience and discipline from the investor. The biggest risk is often not the model itself, but rather abandoning the strategy when things go wrong.

⚠️ RISK WARNING

Investing in financial markets always involves risk. Past performance is no guarantee of future results, and there is a possibility that you may lose all or part of your invested capital. Our analyses and indicators are based on historical data and statistical models, but these models cannot predict future market movements with complete certainty.

The value of investments may fluctuate significantly due to market conditions, company-specific factors and global economic events. It is important that you carefully consider your financial situation and your ability to bear potential losses before investing. The Service does not provide personal investment advice and recommends that you seek independent financial advice before making any investment decisions.

NeuroQuant employees may own or trade securities mentioned in analyses or based on indicators used in our services. This may potentially create conflicts of interest, but we strive for full transparency and professional integrity in all our activities. Following our analyses and indicators involves increased risk if the market moves in an unpredictable manner. You should only invest money that you are prepared to lose and understand that past performance, analyses or models provided through the service do not guarantee future results.