More Norwegian stocks – more opportunities to find gems

Following requests from many of our customers, we have now expanded the range of Norwegian stocks – from 151 to a full 252. This means that you as a user have even better opportunities to analyze, filter and find interesting companies on the Oslo Stock Exchange using our strategies, rankings and ratings.

Just like for Swedish and Danish shares, we also offer factor rating on Norwegian companies (premium only). The ratings help you quickly get an overview of a company's fundamental strengths and weaknesses - without having to dig into annual reports or analysis summaries.

5 smart ways to use our factor scores in your strategy

-

Build a portfolio with strong fundamentals and a positive trend

Combine high Fundamenta Score with positive price behavior (e.g. new 52-week highs, trend ratings or 12-1 momentum). This gives you companies that both look good “under the hood” and have the market’s tailwind at their back – perfect for a robust stock portfolio. -

Filter out stable, quality companies with low risk

Search for stocks with high Quality Score and high Risk ScoreThis gives you companies with high profitability, low debt and stable price development – excellent for long-term exposure or a defensive part of the portfolio. -

Avoid pitfalls – watch out for low win quality

A low Win Score may signal that recent profits have been driven by one-offs or temporary cost-cutting. By filtering out companies with weak earnings ratings, you reduce the risk of future profit warnings and setbacks. -

Optimize portfolio with volatility-adjusted weights

Use our volatility-adjusted portfolio weights together with factor ratings to allocate more capital to stable companies with high quality and lower fluctuations – and less to companies that are more volatile. This results in a more balanced and risk-controlled portfolio. -

Create your own strategies – e.g. relative strength + low risk

Do you want to invest in stocks that are already showing strength? Filter for companies with a high Relative Strength Rank (outperformers) and a high Risk Score (low actual risk). This gives you a portfolio with clear trend exposure, but with calmer movement patterns. A smart combination for those who want to follow the trend without losing sleep.

Here's a reminder of what our ratings actually show:

Win Score (1–5)

A rating of the company's profit development and the conditions to maintain it. We distinguish between sustainable improvements (e.g. cash flow, efficiency) and temporary boosts (e.g. one-off revenues).

Rating Score (1–5)

Based on several key ratios (e.g. P/E and P/S), both relative to the company's history and to the sector. Adjustments are made for banking and real estate. High score = attractive valuation.

Quality Score (1–5)

How profitable and financially stable is the company? We weigh in margins, debt, earnings quality and dividends (without penalizing companies that do not pay dividends).

Risk Score (1–5)

How much does the stock fluctuate – both in everyday life and during extreme events? We look at volatility, beta, correlation and historical movements. A high score = low risk.

Fundamentals Score (1–5)

A balance of profit, quality, valuation and risk – where profit and quality weigh most heavily. A high rating implies strong fundamentals, which is historically important for long-term returns.

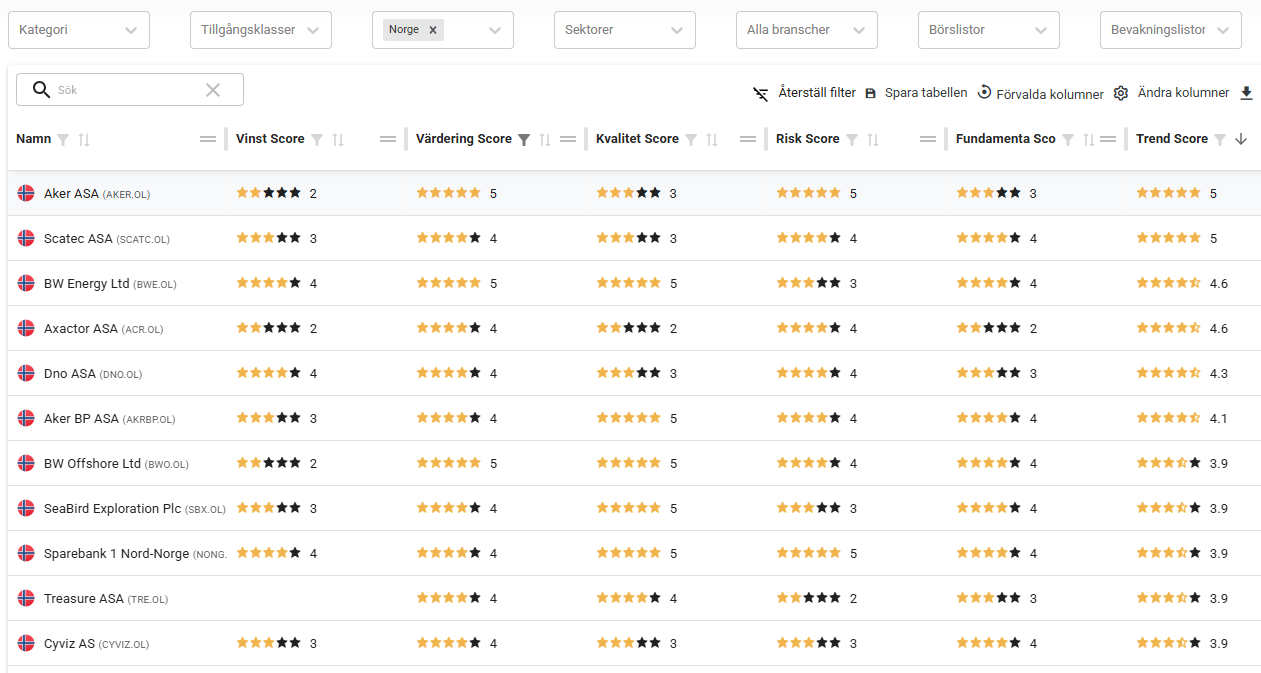

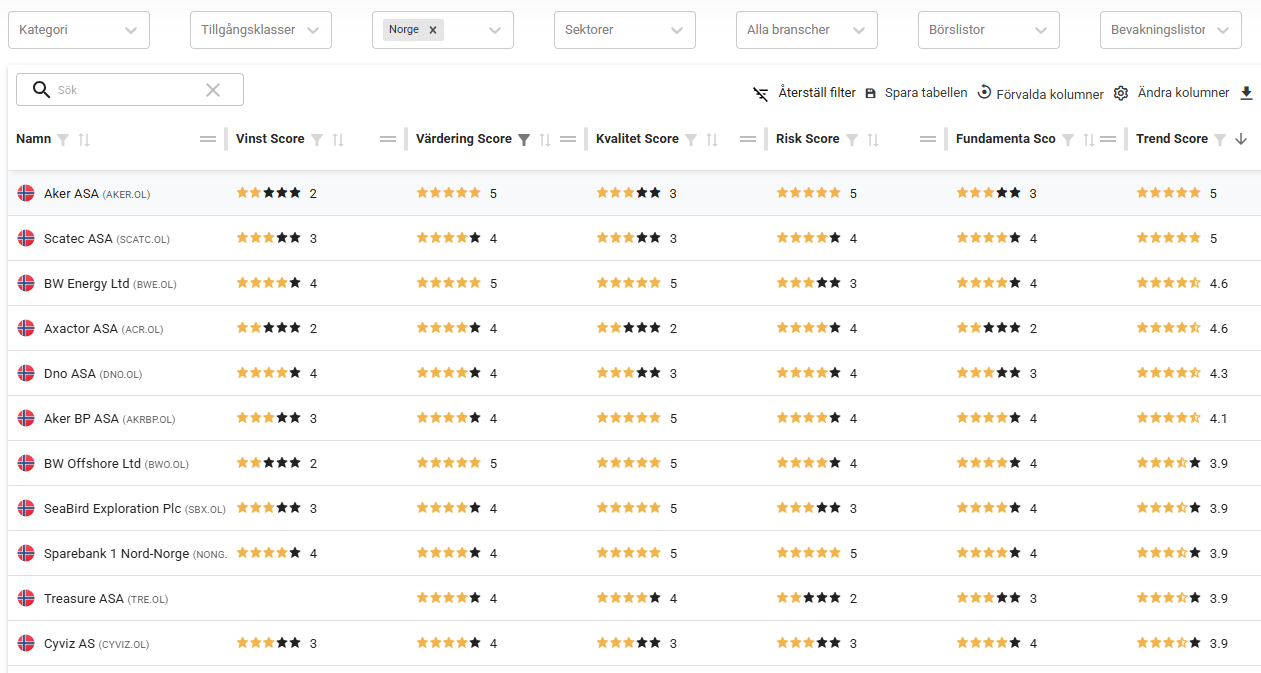

Example of what filtering might look like on the platform

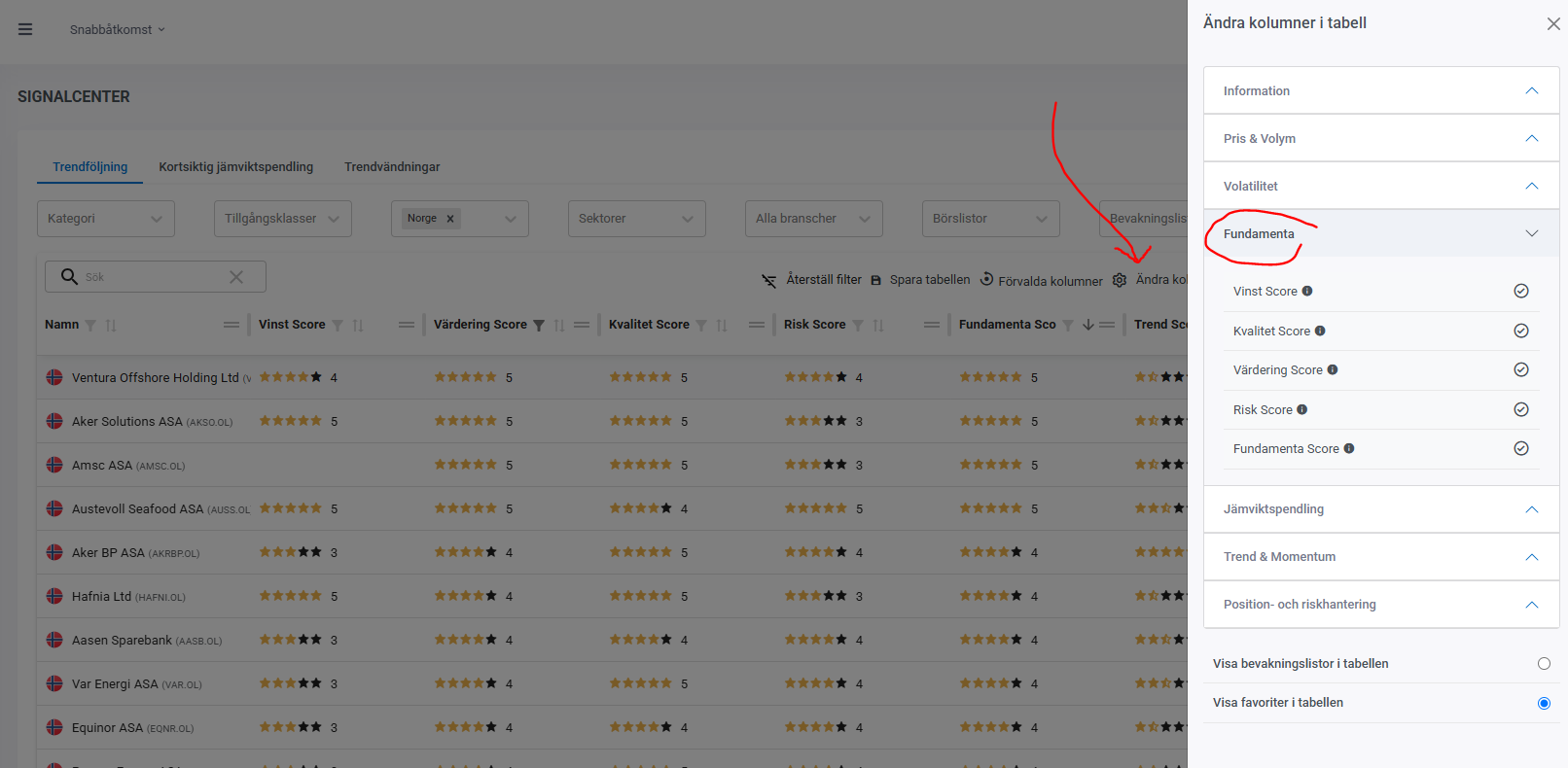

How to create a list

Click on “Change columns” in the top right of a table. Under the “Fundamentals” category you will find the different factor ratings.