Mortgages – risk bomb or turbo in the portfolio?

Many private investors equate leverage with higher risk. But the truth is more nuanced. Leverage in itself is neither good nor bad – it is a tool. Used incorrectly, it can become a risk bomb, used correctly, it can strengthen an already robust strategy and increase long-term returns.

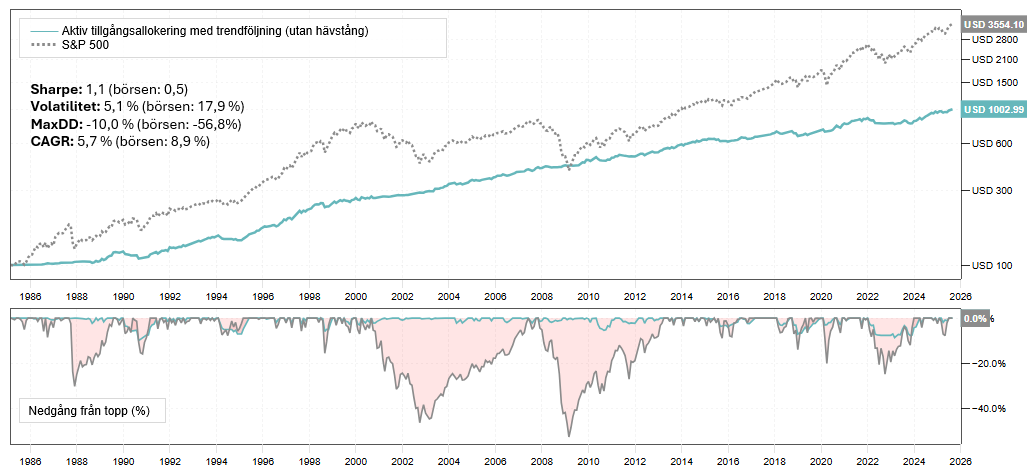

To illustrate what I mean, let's look at a real-world example. It's not an advanced hedge fund model, but a simple strategy that anyone can understand. Yet it shows why leverage doesn't have to be dangerous. On the contrary, it can be one of the most powerful pieces of the portfolio puzzle.

Example of an active asset allocation strategy

This example invests in stocks, government bonds, and gold and uses a simple trend-following rule (12-month moving average). Depending on the prevailing trend, the portfolio will sometimes be fully invested and during certain periods will have cash. No transaction costs are included.

Backtesting since 1985:

- Sharpe ratio: 1.1 (stock exchange: 0.5)

- Volatility: 5.1% (stock market: 17.9%)

- Maximum decline: -10.0% (stock market: -56.8%)

- CAGR: 5.7% (stock market: 8.9%)

The strategy does not outperform the stock market in absolute returns, but offers a higher risk-adjusted return, a significantly smoother journey and a risk profile that enables controlled leverage. Anyone who only looks at absolute returns is thus missing the most important thing.

Login required to read the full article

Not a customer? Open an account to access our analytics service.

⚠️ RISK WARNING

Investing in financial markets always involves risk. Past performance is no guarantee of future results, and there is a possibility that you may lose all or part of your invested capital. Our analyses and indicators are based on historical data and statistical models, but these models cannot predict future market movements with complete certainty.

The value of investments may fluctuate significantly due to market conditions, company-specific factors and global economic events. It is important that you carefully consider your financial situation and your ability to bear potential losses before investing. The Service does not provide personal investment advice and recommends that you seek independent financial advice before making any investment decisions.

NeuroQuant employees may own or trade securities mentioned in analyses or based on indicators used in our services. This may potentially create conflicts of interest, but we strive for full transparency and professional integrity in all our activities. Following our analyses and indicators involves increased risk if the market moves in an unpredictable manner. You should only invest money that you are prepared to lose and understand that past performance, analyses or models provided through the service do not guarantee future results.