Pessimism without a stock market crash – a warning signal or a buying opportunity?

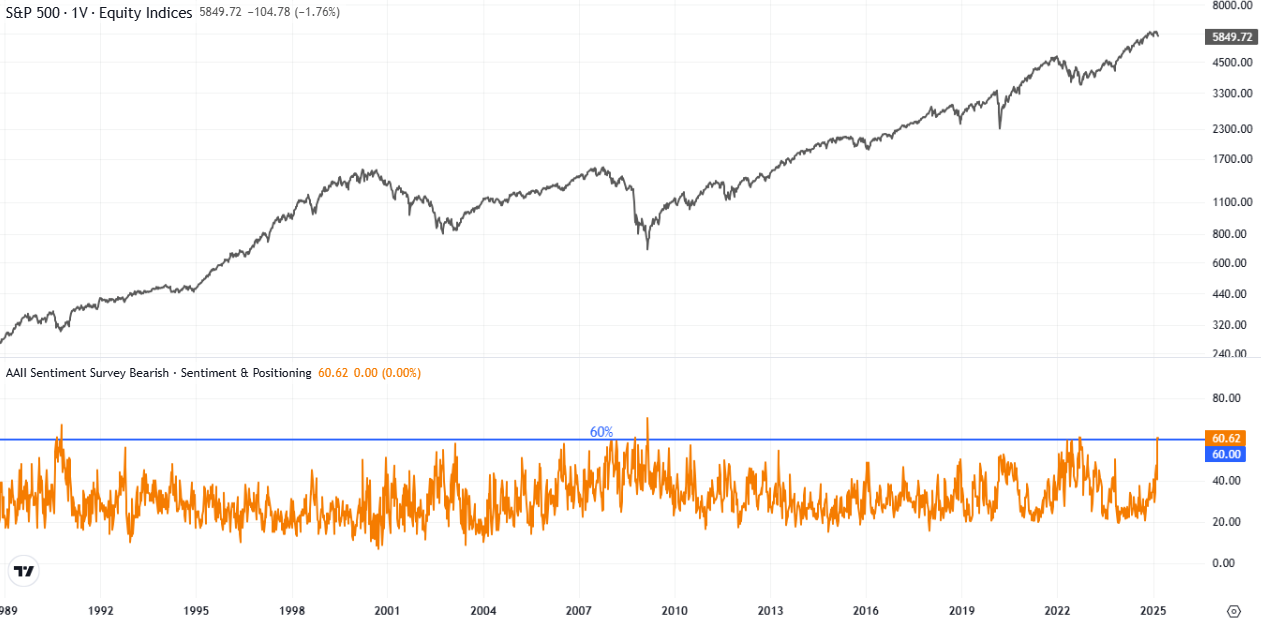

One of the indicators I study to quantify investor sentiment is the survey from AAII (American Association of Individual Investors). They ask how private investors feel about the stock market over the next 6 months. AAII can be seen as the American equivalent of Aktiespararna, but with a greater focus on investment models and analysis rather than vested interests.

According to AAII, many investors are now very negative about the stock market. Interestingly, this often happens after major stock market declines, when many extrapolate declines into the future and are influenced by negative media reporting. Now 60% are negative about the stock market even though it is trading just under 5% from its previous record level.

S&P 500 (weekly) och AAII Sentiment Bearish

How can this observation be interpreted?

The above observation can be interpreted in several ways depending on the context:

-

Feelings of guilt after a strong rise

If the stock market has been strong for a while but investors are still negative, it may indicate that many have missed the upside and are now unsure whether it is too late to jump in. Those who have been skeptical for a long time may continue to hold onto their negative view, even though the market is not falling. -

Macroeconomic or geopolitical concerns

Sentiment can be affected by factors such as interest rates, inflation, economic signals and geopolitical risks, even if the stock market is weathering these. Historically, the market has not reacted particularly negatively to Trump's policies, but if investors see his return as more chaotic this time, it could create concern. -

Cognitive dissonance and miscalibration

Many investors have become accustomed to negative macro news quickly impacting the stock market in recent years. When this does not happen, it can create dissonance – they believe the market should fall but see it continue to rise. -

Positioning and risk aversion

Even though the stock market is trading just under 5% off its peak, investors may have positioned themselves more defensively, perhaps by holding more cash or buying defensive assets. This means their sentiment is negative even if they have not actively contributed to a decline through selling. -

A potentially contrary signal value

Historically, extremely negative sentiment levels have often been a positive signal for the stock market, especially if the market has not already fallen sharply. If many investors are negative despite the stock market being up, it could mean that there is more capital on the sidelines that can drive the market further. -

Fear of an imminent correction

After a prolonged uptrend, investors may begin to believe that the market is “overextended” and that a correction is imminent. They are negative because they do not believe that the current level can last very long.

If sentiment continues to be weak despite a stable market, it could be a sign that investors are slowly being forced to change their view and start buying in, which paradoxically could lead to continued strength. Alternatively, it could be a warning signal that underlying weakness has not yet translated into price action.

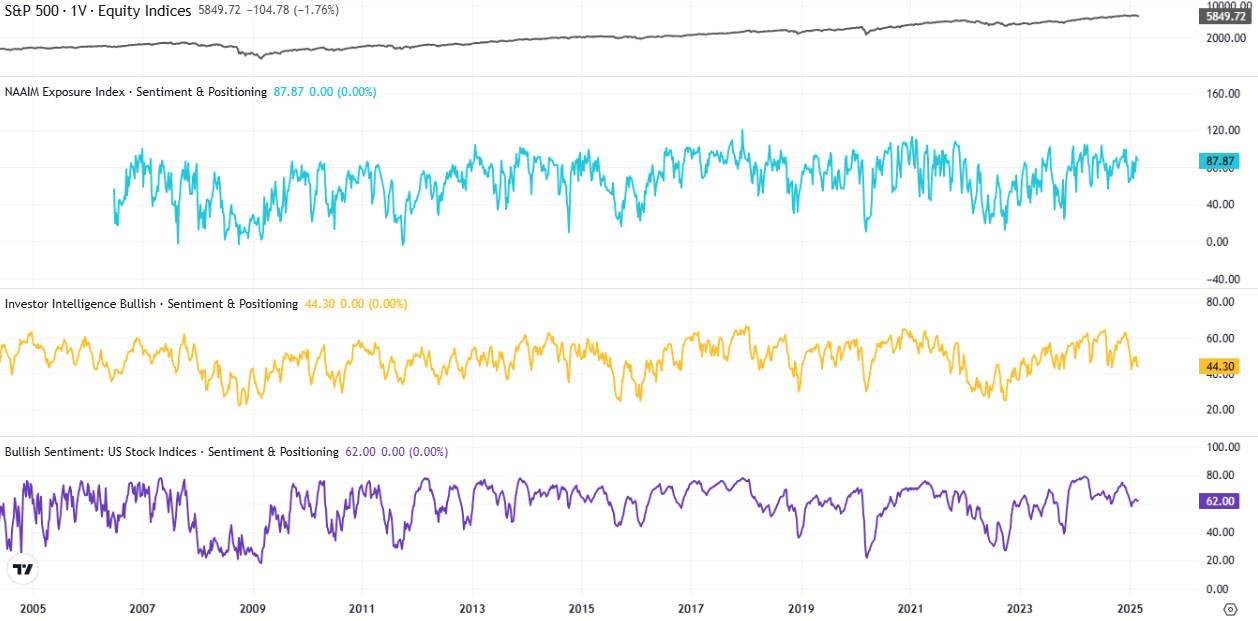

AAII is not confirmed by other sentiment indicators

If all sentiment and positioning indicators showed extreme negativity at the same time, it could have been a clear contrarian signal – that the stock market was likely to rise because too much pessimism often leads to buying opportunities. But that is not the case.

The indicators below do not show the same pessimism as the AAII survey.

S&P 500 (weekly), NAAIM, Investor Intelligence and Bullish Sentiment (high level = optimism)

Conclusion

Our starting point is that all economic, technical and sentiment indicators have their shortcomings and sometimes give false signals. Actors who highlight individual indicators as crucial for future development either lack knowledge, are naive or are trying to create engagement to attract more followers. We combine several indicators, because the probability of false signals decreases when we use a broader set. Our interpretation of the sentiment is negative, as our combined indicator set falls from high levels.