Update: Investment strategies (multi assets)

We offer smart model portfolios for long-term savings, adapted to different risk levels. Our strategies help you spread your risks, reduce fluctuations and at the same time increase the possibility of good returns. Keep in mind that historical returns do not guarantee future results, and our strategies are for inspiration – not personal advice.

Content

- All-weather portfolios

- Dynamic strategies

- Current allocation

- New signals

1. All-weather portfolios

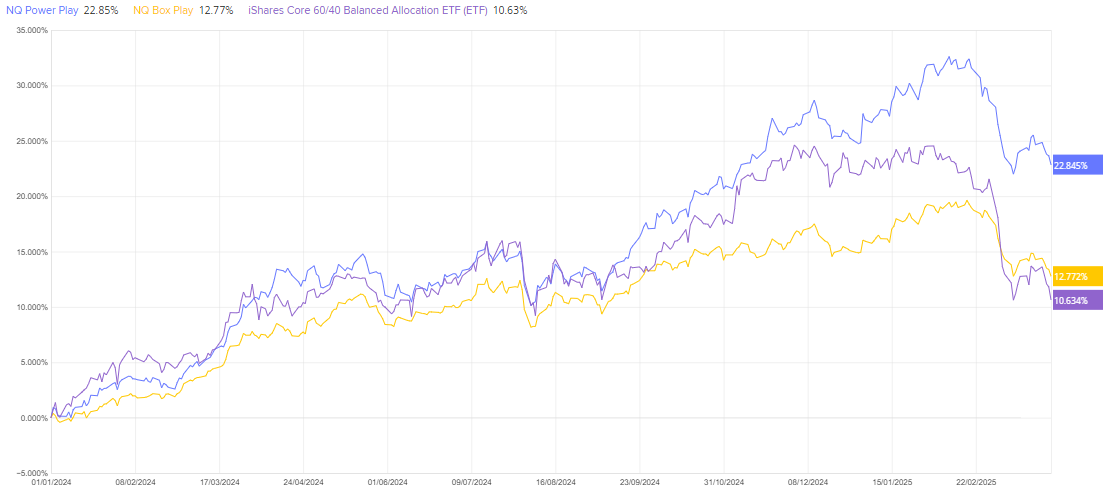

2024 was a strong year for diversified strategies, as equity markets rose in line with the price of gold. The start of 2025, however, has been more challenging, with a trend around the zero line, where a rapid appreciation of the krona has weighed on holdings in euro-denominated ETFs.

Keep in mind that diversification outside of stocks can be both a blessing and a curse, depending on the market climate. Some years, portfolios with exposure to other asset classes reward us well, while in other years they can create frustration and cause many investors to abandon the strategies. This is because comparison with stock indices is deeply ingrained in us and the “fear of missing out” is a strong psychological driver.

| Name | Universe | Number of holdings | Risk |

| Box Play | ETFs/funds | 7 | Low |

| Power Play* | ETFs/funds | 9 | Means |

The strategies are rebalanced semi-annually.

Development since 2024 (SEK)

2. Dynamic strategies

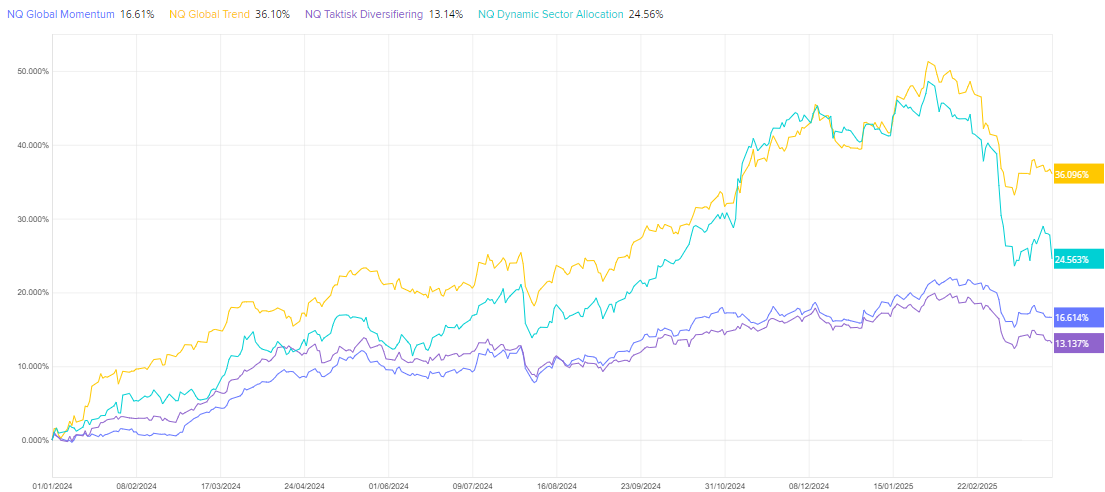

Dynamic strategies are active, but do not speculate on macro or market peaks and troughs. They are based on robust methods with clear rules, creating a stable and consistent investment process.

After a strong start to the year, the strategies have been pressured by reduced risk appetite globally and a negative currency impact from the rapid appreciation of the krona. Volatility and drawdowns of this type are to be considered natural and are within the risk profile of the strategies.

| Name | Universe | Number of holdings | Risk |

| Global Trend | ETFs | 3 | Means |

| Global Momentum | ETFs | 5 | Means |

| Tactical Diversification | ETFs/funds | 9 | Low |

| Dynamic Sector Allocation | Sector ETFs | 4 | Means |

Dynamic strategies are rebalanced monthly.

Development since 2024 (SEK)

Allocation and new signals

Login required to view allocation and new signals

Not a customer? Open an account to access our analytics service.