Update: Volatility & Quality

Volatility & Quality is a factor-based strategy that aims to create exposure to stocks with low volatility and a high quality rating. Rebalancing occurs once a month and the goal is to achieve a higher risk-adjusted return than the stock market.

All of our factor-based strategies are based on concepts where there are behavioral explanations for why they have the potential to outperform. These strategies help us act more rationally. By following a systematic strategy, we avoid the mistake of selling winning positions too early, for example.

Our model portfolios are included in our premium package. Click here to read more about our strategies on the website.

Information

- Direction: Long-only (no short positions)

- Strategic direction: Quality, volatility and trend

- Investment universe: Nordic countries & USA

- Portfolio weights: Equally weighted (capital/number of positions)

- Rebalancing frequency: Monthly

Development

In 2025, the strategy has been weighed down by declines in the US holdings, which make up 50% of the portfolio. The stronger krona has also further amplified the decline. The best contributors have been Lundin Gold, Clas Ohlson and Orkla. The biggest detractors have been Vistra, Celestica and Limbach.

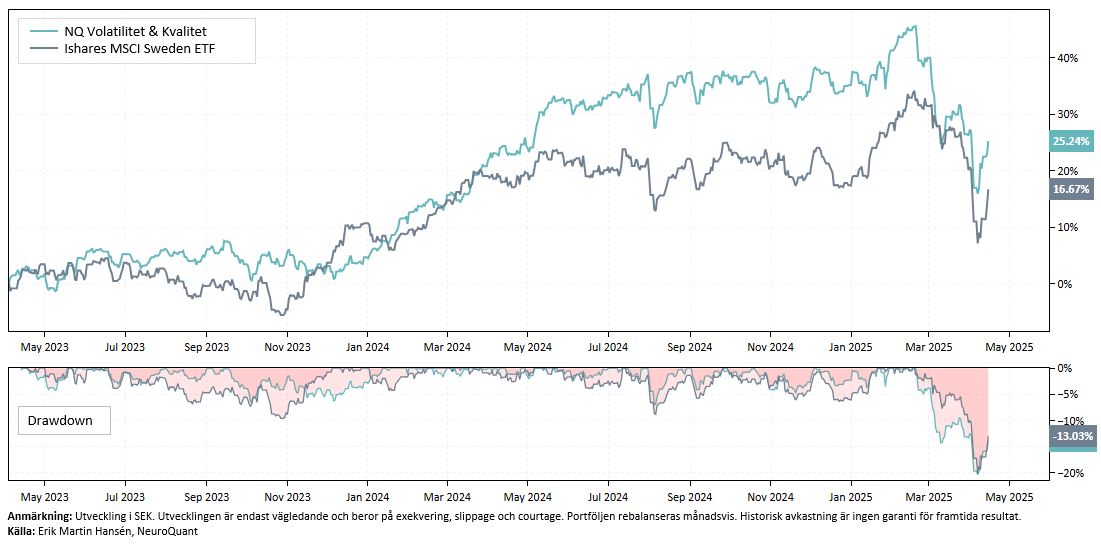

Since the start of April 2024, the portfolio has returned 25%, compared to the Stockholm Stock Exchange's 17%. The Sharpe ratio has been 0.7 compared to 0.3 for the Stockholm Stock Exchange. Volatility has been 11.7% and tracking error against the Stockholm Stock Exchange is 13%. Note that the strategy changed its universe for 2025 and currently allocates 50% of its capital to the US.

Monthly development (%)*

| Year | Jan | Feb | Mar | Apr | Maj | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total |

| 2023 | 1.2 | 3.0 | 1.0 | 0.8 | -0.7 | -1.8 | 1.2 | -2.2 | 2.2 | 4.6 | |||

| 2024 | 5.6 | 3.4 | 5.7 | 3.0 | 6.6 | 0.2 | 3.3 | 0.1 | -0.2 | -3.5 | 1.3 | 0.9 | 29.1 |

| 2025 | 4.6 | -0.9 | -9.8 | -0.3 | -6.8 |

*The development is indicative only and depends on execution, slippage and brokerage.

Holdings and changes in the portfolio

Login required to view our model portfolios

Not a customer? Open an account to access our analytics service.