Discover our best training videos

Over the past few months, I have recorded several educational videos packed with concrete tips, educational explanations, and insights into how I think when we build our strategies.

In this post, I have collected the best clips in one place – so you can easily deepen your knowledge, become a smarter investor, and at the same time get a better feel for how our platform works.

It doesn't matter if you are a beginner or already working with strategies - here you will find inspiration, logic and tools to take with you into your own trading.

We go through everything from how we set up systematic rules, to why we avoid subjective decisions and how we manage risk in a thoughtful way.

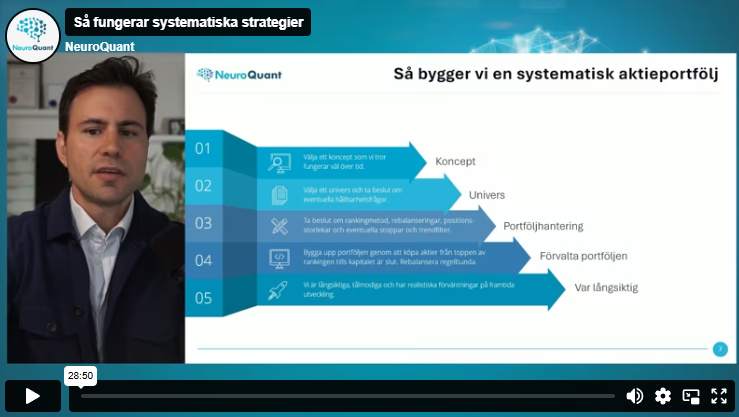

How systematic strategies work

Many investors blindly fumble through tips, gut feelings and loose opinions. We do the opposite. Our strategies are systematic, well thought out and based on clear rules – no guesswork.

In this video, we go through both the advantages and disadvantages of systematic strategies – and show you how you can build and trade them on your own.

Two momentum strategies: Pure Trend and Pure Momentum

We review our two models Pure Momentum and Pure Trend – both designed to systematically capture stocks that are performing strongly and let the winners continue to work.

You'll learn how the models work, what sets them apart, and what makes them robust over time. We'll also show you how you can use them in practice – without guessing, speculating, or chasing the next "tip."

Perfect for those who want to understand the power of trend and momentum – and how you can exploit it in a systematic way.

Learn to trade with Trend & Trade Range

When you trade equilibrium swings with our proprietary model Trend & Trade Range.

Trend & Trade Range (TTR) is our model used to generate buy and sell signals in equilibrium swing strategies. The signals can be combined with a trend filter to avoid buying in oversold conditions during a downtrend. Perfect for those who want to create a clearer structure and trade more systematically.

Stock market quotes we love to believe in – but which often lead you astray

We love wise quotes. Short, smart sentences that sound like truths. The problem? Many of these quotes are either simplified, misinterpreted, or downright dangerous if you follow them slavishly. They provide a false sense of security in an uncertain world. More critical thinking and less blind faith in old “truths” will make us better investors.

The Stop Loss Trap: Why They Can Hurt Your Returns

Stop losses are often used as an obvious tool to limit losses – but what happens when the market doesn't behave like it used to? In this webinar, we'll go over why tight stops often do more harm than good in today's noisy and mean reverting markets. You'll gain insights from real-world examples, backtests and strategies that show you how you can instead manage risk in a more robust way.

Identify your opponents in the market

This time we're talking about something that almost no one else does: Who are you really competing against in the market?To succeed, it's not enough to have a strategy – you have to understand what mistakes others make, and how you can profit from them.

We go through:

- Who is your opponent in different time perspectives?

- Why the market is a zero-sum game in the short term

- How systematic strategies such as mean reversion and trend following exploit structural behaviors of other actors

We base our work on recent studies, which show how professionals systematically make big money from private investors - often without them even knowing it.