Why do losses feel so much worse than wins?

If you've ever felt like a punch in the gut when you lose money in the stock market, but an equally big gain just makes you shrug, you're not alone. This phenomenon is called loss aversion, and it's one of the most well-established insights in behavioral economics.

Research by Daniel Kahneman and Amos Tversky showed that people experience losses about twice as strongly as gains of the same size. In other words, the pain of losing $100 feels like you've lost $200, while the joy of gaining $100 doesn't feel very much at all.

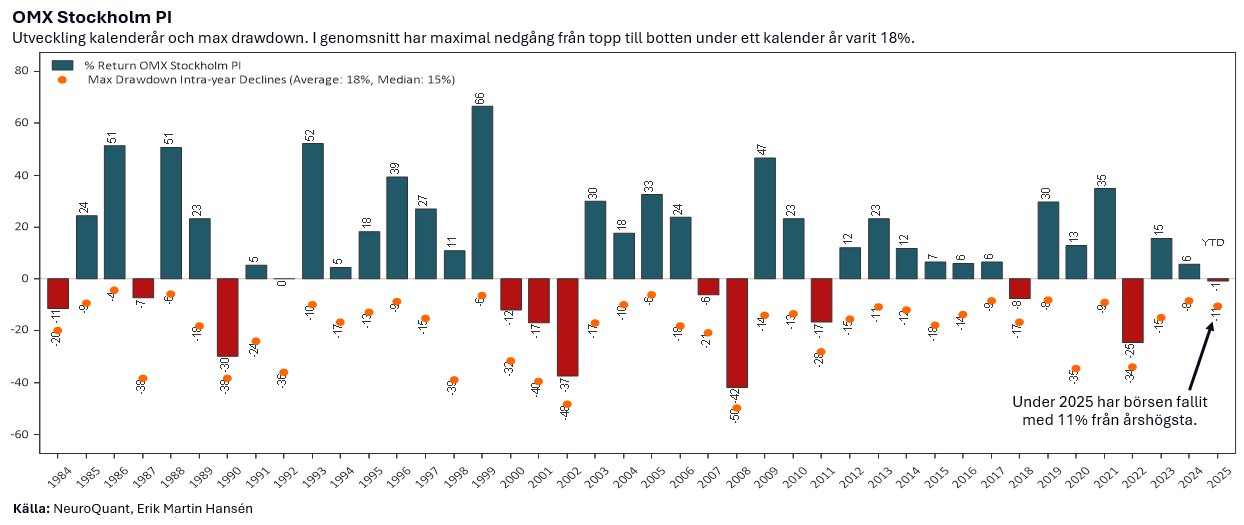

Good to keep in mind: With 100% equity exposure, declines of 5-10% are common, 20% is occasional, and 30% or more are more unusual, but not extreme. Through diversification, we can often limit the decline to below 20% — at least in normal market conditions.

The stock market (OMXSPI) has fallen 11% from its high this year so far. On average, the stock market tends to fall about 18% from peak to trough during a calendar year. If we are feeling bad or making bad decisions due to stock market fluctuations (volatility), we probably need to adjust how we invest.

Why does this matter to investors?

Why does this matter to investors?

Loss aversion often leads to irrational decisions:

- We sell winners too early.

- We hold on to losers for too long.

- We avoid risk, even when it is well calculated.

This emotional rollercoaster can seriously damage long-term returns. Losses feel so painful that investors sometimes choose to stay out of the market altogether, even during periods of significant upside.

Systematic strategies – a protection against yourself

One way to avoid getting caught in the grip of loss aversion is to use systematic strategiesThese strategies are based on clear rules and quantitative signals, which reduces the risk of letting emotions guide decisions.

Advantages of systematic strategies:

- Objectivity: Decisions are made based on data, not gut feeling.

- Consequence: The strategy acts equally in all market situations.

- Less emotional stress: You don't have to worry about every market fluctuation.

- Long-term focus: You stick to a strategy, even when the market shakes.

Real-life examples

Let's say the Stockholm Stock Exchange falls 5% in two weeks. The feeling of panic spreads, and you consider selling everything. But a systematic strategy may show that it is actually a buying situation, because the market is oversold. By following the strategy, you avoid selling at the bottom.

Conclusion

Losing feels worse is part of being human, but it doesn't have to rule your investments. By using systematic strategies, you can navigate the market with calm and confidence, no matter how turbulent it gets.

Historical returns are no guarantee of future results, but sticking to a proven strategy can be one of the best ways to avoid the psychological pitfalls on the path to long-term success.