Weekly report: Stops triggered in Peab and Corem

The weekly report gives you a quick and clear overview of the market situation. Here you get market commentary, open positions and new signals for weekly strategies, as well as our view on asset and sector allocation. We also summarize whether stocks, bonds or cash are preferable right now - all in one place so that you can easily act with a structured overall picture.

Content:

- Market commentary

- Open positions and signals for weekly strategies

- Asset and sector allocation

- Stocks, bonds or cash to prefer?

1. Market commentary

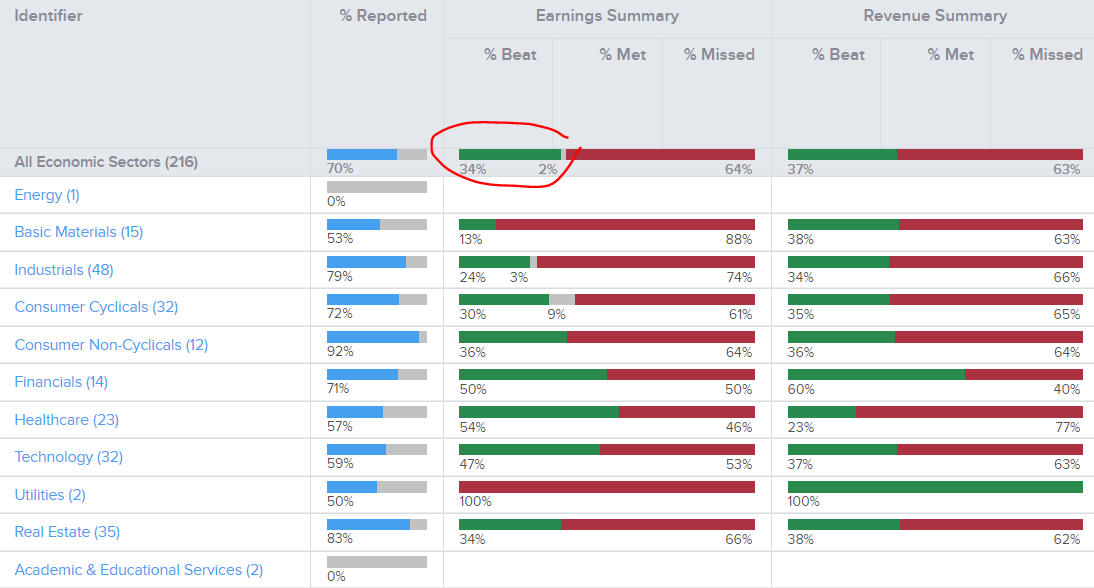

70% of the companies on the Stockholm Stock Exchange have now reported and as always, it is sometimes wine and sometimes water. New information must be priced in quickly, which often leads to large and sometimes seemingly illogical movements. Strong report reactions are common when the market often exaggerates in both the positive and negative directions.

However, we do not spend time trying to explain individual report reactions. Instead, we follow the signals that the market actually gives us. We see no value in trying to explain every swing afterwards, as our focus is on consistently trading systematic strategies.

Only about 35% of the companies on the Stockholm Stock Exchange have met analysts' earnings expectations, which is the lowest level since 2020. This is despite analysts generally adjusting their estimates downward. It sounds negative, but the stock market can still go up if the market believes in improvement going forward.

During the week, OMXS30 was largely unchanged, while commodities recorded gains. OMXS30 is trading just below the 200-day moving average, and an establishment above this level would strengthen the trend rating for the Stockholm Stock Exchange.

Despite the weak overall trend structure, price dynamics on the stock market have shown a more trending behavior, which has benefited our trend and momentum strategies. On the other hand, strategies focusing on equilibrium oscillation have had a more challenging period.

Our weekly trend-following strategy on Swedish stocks is up 25% in 2025, while our strategy based on short-term equilibrium oscillation is only up a couple of percent. Coming back with a blog post about dominant price dynamics and how it affects different strategies.

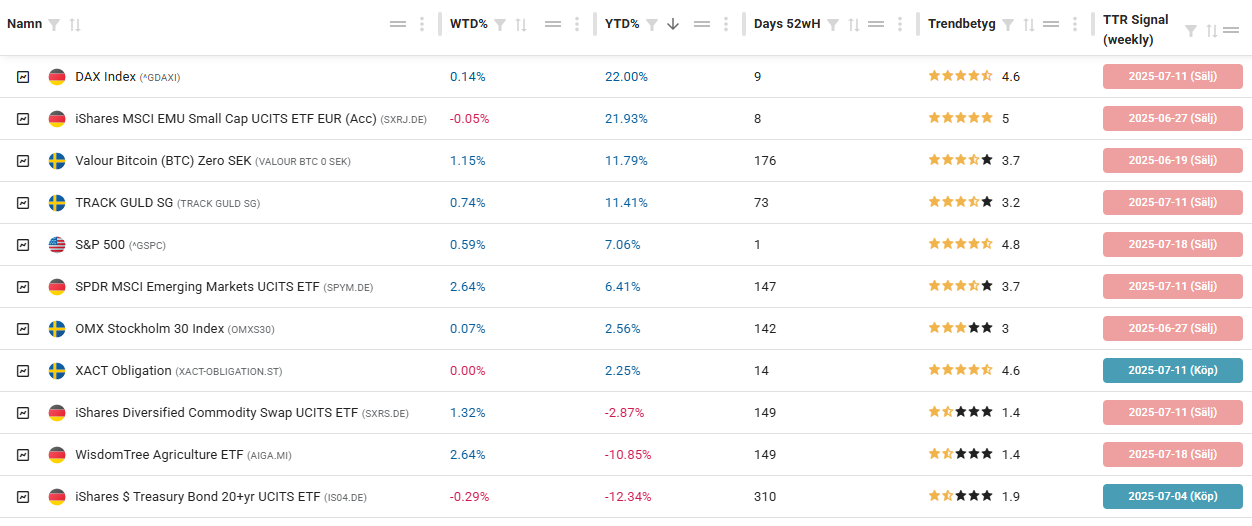

DAX is the big winner in 2024 among major markets in the image below.

Major global markets (sorted by development in 2025)

2. Open positions and signals for weekly strategies

We present open positions and signals for weekly strategies. All are 100% systematic and based on objective signals. Rules and signals for all strategies – except for Gold Tactics Weekly – included in the Premium package. Buy and sell signals for example mean reversion and trend/momentum can be followed in real time on the page Signal center.

These strategies are not model portfolios with a promise to report exact positions every week. The purpose is primarily to inspire and show how the strategies work in practice – so that you as a member can easily follow them yourself directly on the platform. For Gold Tactics Weekly However, we will always communicate current signals.

Click on the links below to read more about the strategies and click here to see an overview of all strategies.

Open positions: Friday, July 19, 2025

| Strategy | Holding |

| Golden Tactics Weekly 1 | No open position in gold |

| Mean Reversion ETF Weekly 2 | TLT ETF (alt. BULL US20Y X2 SG) |

| Mean Reversion OMX Weekly 3 | Peab B, Stora Enso R, Fastpartner A, Addlife B, Tele2 B, Corem Property Group B |

| Trend Following OMX Weekly 4 |

Saniona, ProfilGruppen B, Avanza Bank, mySafety Group B, TradeDoubler, SynAct Pharma, SAAB B, Actic Group, EQL Pharma, RaySearch Laboratories B, CoinShares International Limited, MilDef Group, Cloetta, Lundin Gold, Nelly Group |

1 Trades only gold

2 Max 3 equally weighted holdings of 4 ETFs (SPY, QQQ, GLD, TLT)

3 Max 6 equally weighted holdings (OMX Large Cap stocks in positive trend)

4 Max 15 equally weighted holdings (OMX Large, Mid, Small Cap)

New signals: For Monday, July 21, 2025

Login required to access the full publication.

Not a customer? Open an account to access our analytics service.