Is gold overbought? Better ask if you have a plan

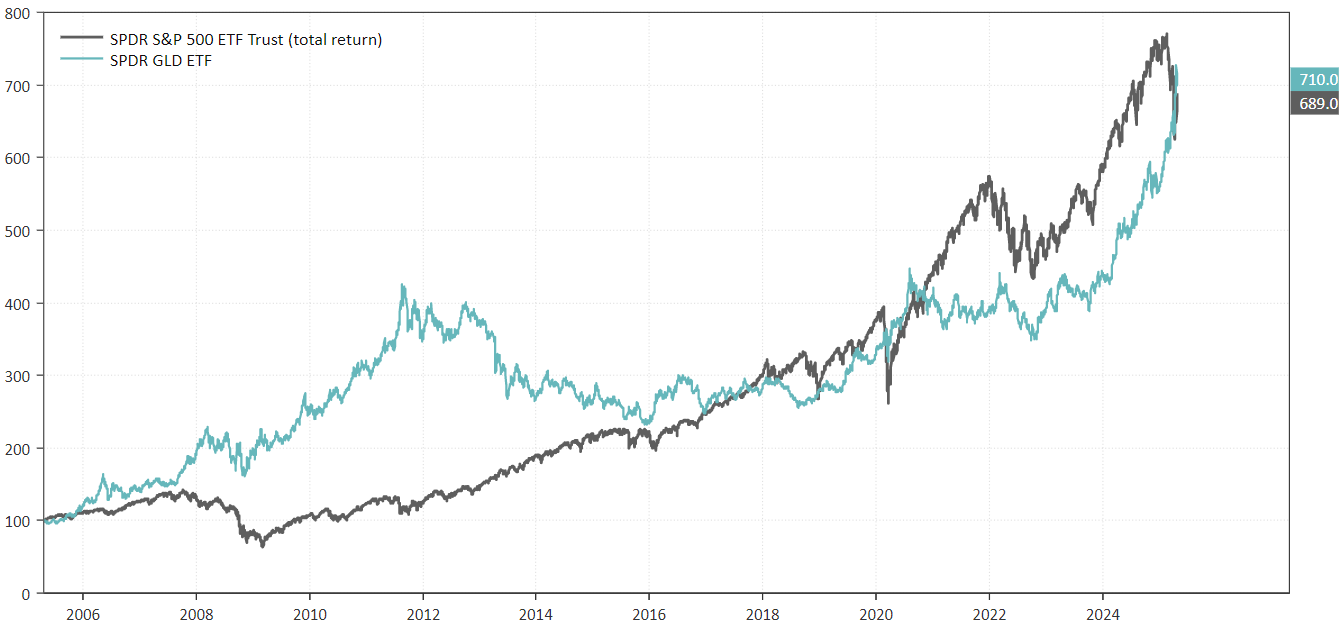

Gold has now beaten the S&P 500 over a 20-year period. It’s easy to overlook that performance. After all, the S&P 500 is an index that systematically weights winners—a long-term momentum strategy that rewards companies whose shares rise in price. Yet gold has had a higher return.

In recent months, we have seen a strong rally in gold. The driving forces often cited in the media are geopolitical concerns, deglobalization, and increased expectations of sustained inflation.

But let's be honest – these kinds of explanations are always retrospective. They don't tell you anything about what's going to happen going forward. And above all: they don't help you make systematic and repeatable investment decisions.

Gold and S&P 500 last 20 years

Narratives explain yesterday – but rarely help move forward

When gold moves up, experts and commentators quickly come into the picture. They tell you why gold has gone up. Inflation, fear, interest rates, central banks, geopolitics – there is always something to point to. But the problem is that none of these factors have a high enough accuracy to build a robust strategy around.

It's not the narrative that creates returns – it's the systematic process behind investment decisions.

The most common question – and why it's wrong

Since I announced that gold had broken out of a multi-year consolidation in the first quarter of 2024, I have been asked the same question over and over again:

“Is it too late to buy gold?“

The short answer: That's the wrong question.

Asking if it's too late to buy gold is like asking if it's too late to brush your teeth. It's not about timing – it's about process. Doing it systematically and consistently increases the chances of getting a good result over time.

Subjective feeling or systematic strategy?

If we base our investments on emotion or gut feeling, we run the risk of constantly chasing yesterday's winners. We jump on trends too late, get off too early, and get burned when the market doesn't follow the script. Instead of trying to guess when to own gold, we should ask a better question:

“Do I have a strategy that says when I should own gold – and when I shouldn't??”

That's how you build a long-term, robust investment approach. It's not about having the right opinion – it's about having the right process.

Rules-based strategies

For my part, I follow a systematic strategy – GOLDW. The strategy either has a position in gold or no position at all and tells you when there is sufficient tailwind for gold. Right now the strategy is positioned for an uptrend – but that could change next week if the signals reverse.

If you ask me what I believe about gold, my answer is: I don't try to believe – I follow my strategies. It may sound boring, but for me it works better.

In addition to the weekly GOLDW strategy, our monthly strategies have Global Momentum and Global Trend gold in their investment universe and thereby profited from the strong rise in gold. These strategies use cross sectional momentum and therefore rotate out of gold when other assets show stronger momentum.

“But isn’t gold overbought?”

Over the past year, there has been a common argument: “Gold is overbought, it should take a break.” But that is a classic misconception.

During structural uptrends, assets always look overbought. That's the very definition of a strong trend. If you get off every time something looks "overbought," you often miss the big moves—the ones that really make a difference in a portfolio.

What many people also don't think about is that an overbought condition can be eliminated in a couple of days.

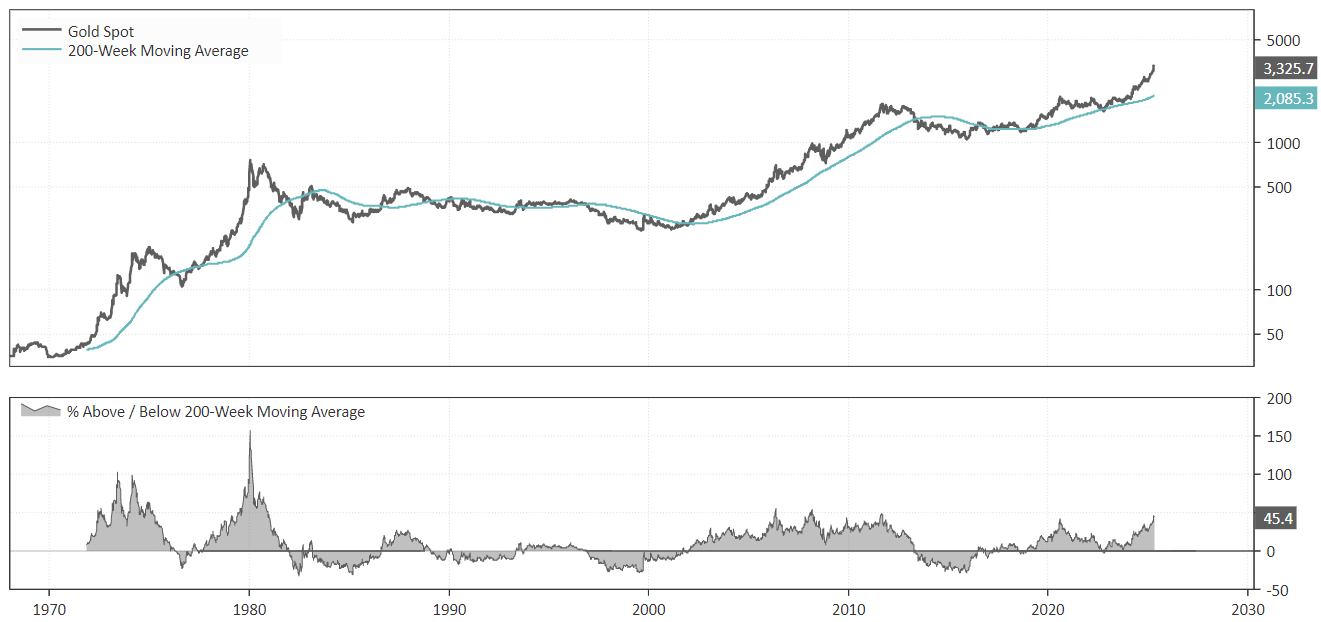

Since the 1970s, gold has had two clear structural bull markets – the first from the late 1960s to the peak in 1980, and the second from the early 2000s to the peak in 2011.

During both of these periods, the “normal” state was for gold to be in a technically overbought position, if you measure the distance from the 200-week moving average.

The Gold Price since the 1970s

Conclusion: Build your investment on process, not forecast

So, is it too late to buy gold? That’s a moot point. The real question is: “Do I have a process that tells me when to buy – and when to sell?”

It's not emotion that should guide your portfolio. Not a media expert, not a fund manager who is always positive about gold – and definitely not a social media guru.

What should govern is process, discipline and data-driven decisions. That is what makes the difference over time. And that is precisely why we own gold now. Not because it feels right – but because our strategy says it is right.