Volatility & Quality is a factor-based strategy that aims to create exposure to stocks with low volatility and a high quality rating. Rebalancing occurs once a month, and the goal is to achieve a higher risk-adjusted return than the stock market....

Read more

Technical analysis is very popular and often the first method that beginners encounter when they start trading actively, especially if they focus on short-term trading. With simple graphs and clear patterns, technical analysis seems to promise quick results and easy...

Read more

Prioritize survival over maximum return! With global asset allocation, we build capital over time, without having to expose ourselves to the emotional roller coaster of the stock market. The path to the goal is crucial to succeeding with a long-term perspective and achieving success. With the help of...

Read more

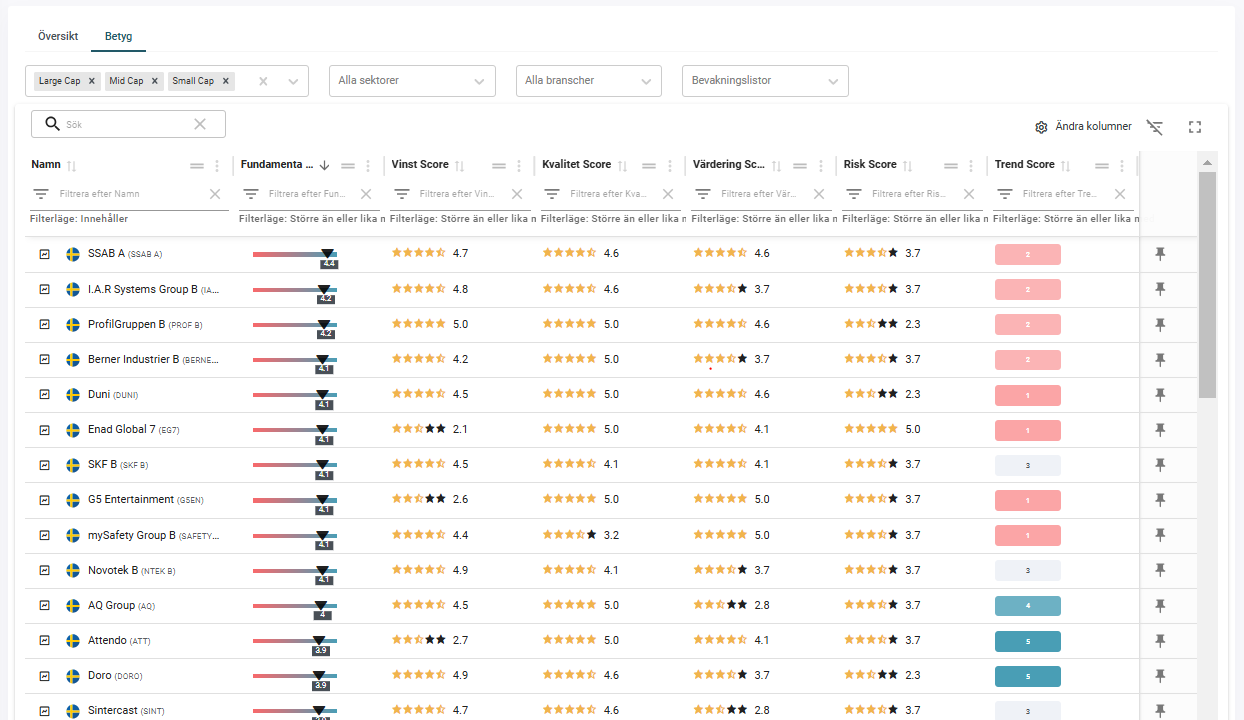

On our analysis platform, we have gathered everything you need to create a systematic and well-thought-out stock portfolio, based on objective factors and price movements. With unique calculations, a powerful fundamental rating and a trend rating, you get an invaluable overview of Swedish companies...

Read more

Top Picks Momentum buys and sells stocks based on our Pure Momentum strategy. This strategy identifies low-volatility uptrends, with the assumption that these trends often last longer than expected. While momentum strategies don't always perform optimally...

Read more

Navigating the stock market is hard enough without being distracted by the wrong people. On Finanstwitter (or other social platforms) it is teeming with opinions, “experts” and market gurus who want to guide you – or rather, lead you astray. If you want to keep...

Read more

Finally a reporting period with new data from companies for investors to absorb. It is often said that the market is quick to price in new information. But is that really true or is there an anomaly that we can keep in mind when...

Read more

Value & Momentum is a strategy that combines the factors of value and momentum to buy cheap companies that are trading with good momentum. Portfolio weights are adjusted for volatility and changes are made once a month. Holdings and position sizes are included in the premium package and...

Read more

Ray Dalio popularized the concept of the “All-Weather Portfolio” through his hedge fund Bridgewater Associates, which is today the world’s largest hedge fund with over $100 billion in capital. Let’s try adding momentum to the strategy. But first, some background information on the concept of the all-weather portfolio. Dalio was...

Read more

Volatility & Quality is a factor-based strategy that aims to create exposure to stocks with low volatility and a high quality rating. The investment universe consists primarily of Swedish companies, but the strategy also allows investments in foreign companies. Rebalancing occurs on a...