In connection with Wednesday's episode of the Market Pulse, we are running a live stream – and you are most welcome to join us! During the broadcast, you will have the opportunity to ask questions about our service, our strategies and the tools we offer. This is...

Read more

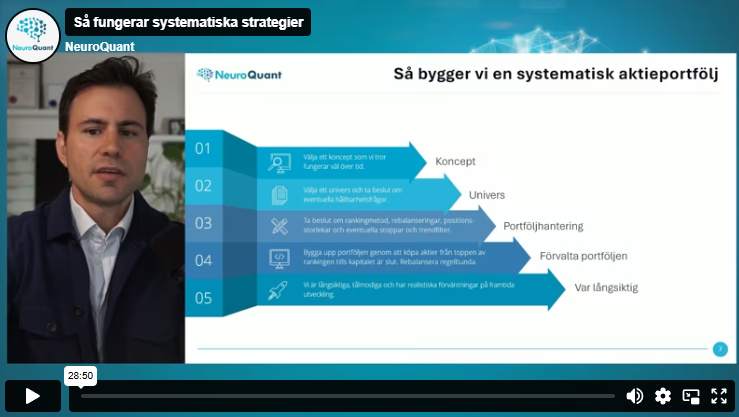

Over the past few months, I've recorded several educational videos packed with concrete tips, educational explanations, and insights into how I think when building our strategies. In this post, I've collected the best clips in one...

Read more

Market Pulse starts the week with an overview of the global market situation. We filter out the noise and skip the speculation - here you get an objective analysis based on robust data, clear signals and proven methods. Our analysis is based on GRIP: basic situation,...

Read more

Market Pulse starts the week with an overview of the global market situation. We filter out the noise and skip the speculation - here you get an objective analysis based on robust data, clear signals and proven methods. Our analysis is based on GRIP: basic situation,...

Read more

We offer smart model portfolios for long-term savings, adapted to different risk levels. Our strategies help you spread the risks, reduce fluctuations and at the same time increase the possibility of good returns. Keep in mind that historical returns do not guarantee future results, and our strategies are...

Read more

Marknadspulsen startar veckan med en genomgång av det globala marknadsläget. Vi försöker filtrera bort bruset och skippar spekulationer – istället får du en objektiv analys baserad på robust data, tydliga signaler och beprövade metoder. Vi går igenom signaler från våra...

Read more

Value & Momentum is a strategy that aims to identify companies with good fundamentals and positive market behavior. Portfolio weights are adjusted for volatility and changes are made once a month. With patience, discipline and systematic position management, we have good...

Read more

Marknadspulsen startar veckan med en genomgång av det globala marknadsläget. Vi försöker filtrera bort bruset och skippar spekulationer – istället får du en objektiv analys baserad på robust data, tydliga signaler och beprövade metoder. Vi går igenom signaler från våra...

Read more

Volatility & Quality is a factor-based strategy that aims to create exposure to stocks with low volatility and a high quality rating. Rebalancing occurs once a month and the goal is to achieve a higher risk-adjusted return than the stock market....

Read more

Marknadspulsen startar veckan med en genomgång av det globala marknadsläget. Vi försöker filtrera bort bruset och skippar spekulationer – istället får du en objektiv analys baserad på robust data, tydliga signaler och beprövade metoder. Vi går igenom signaler från våra...