Monthly Update: Top Picks Momentum

The Top Picks Momentum model portfolio buys and sells stocks based on our Pure Momentum strategy. This strategy identifies low-volatility uptrends with a medium-term lookback period, with the assumption that these trends often last longer than expected.

A characteristic of momentum strategies is that a few big winners often account for a large part of the total return. The strategy is to follow these winners while avoiding the bigger losers. However, momentum is difficult for many to follow in practice and requires clear, structured rules to be able to take advantage of its potential.

Click here to read more about our factor-based equity strategies.

Information

- Direction: Long-only (no short positions)

- Strategic direction: Volatility-adjusted price momentum

- Investment universe: Sweden (also Nordic)

- Portfolio weights: Volatility-adjusted

- Rebalancing frequency: Monthly

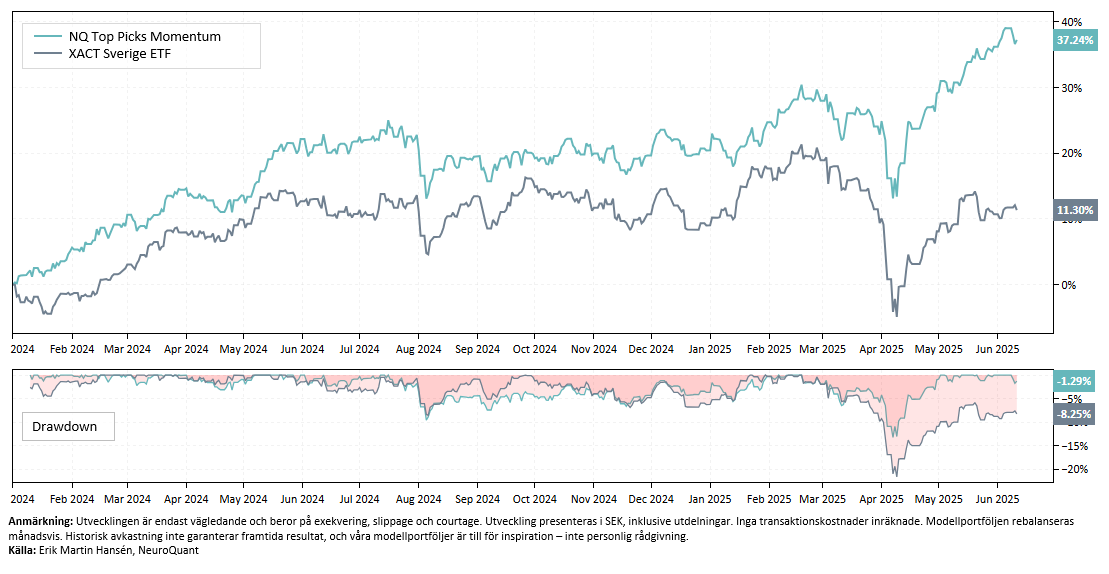

Development

Since January 2024, Top Picks Momentum has risen by 37%, compared to the Stockholm Stock Exchange's rise of around 11%. Among the main contributors are Lundin Gold, Ambea and Mildef Group. On the downside, Wästbygg Gruppen, Surgical Science and XSpray Pharma have weighed the most on returns.

In 2025, the strategy has continued to deliver by riding winners and cutting losers, with support from, among others, Norbit, Lundin Gold, Handelsbanken, Mildef Group, Kongsberg Gruppen, RaySearch and Clas Ohlson.

The Ovzon price rocket has also contributed positively to the portfolio. However, the share's higher volatility has meant a low portfolio weight, which has meant that it has had less of an impact than one might have thought.

An important reminder: momentum strategies are often characterized by many small losses, while a few holdings account for a large portion of the return. Buying stocks that have already risen goes against many people's gut instincts – but this is precisely what makes the strategy work over time.

Monthly development (%)*

| Year | Jan | Feb | Mar | Apr | Maj | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total |

| 2023 | 8,8 | 1,3 | 1,4 | -0,4 | -0,6 | 2,1 | -2,1 | -4,4 | -2,7 | -0,2 | 0,5 | 3,7 | 7,0 |

| 2024 | 5,0 | 3,6 | 5,1 | -0,7 | 7,6 | -0,3 | 0,8 | -2,7 | 0,4 | -0,2 | -0,1 | 0,7 | 20,4 |

| 2025 | 3,6 | 2,6 | -4,0 | 5,1 | 5,5 | 0,8 | 14,0 |

*The development is indicative only and depends on execution, slippage and brokerage.

Changes

We sell stocks that fall out of the rankings and use the cash to buy new holdings. Portfolio weights are determined through a systematic method, which eliminates subjective decisions and ensures that all holdings have the same theoretical opportunity to contribute to the portfolio's performance.

Regular rebalancing keeps risk under control and is an often underestimated key to long-term success.

Holdings and portfolio weights

Login required to view our model portfolios.

Not a customer? Open an account to access our analytics service.

ℹ️ IMPORTANT INFORMATION: TOP PICKS MOMENTUM

The Top Picks Momentum model portfolio is based on our Pure Momentum model with objective and transparent rules – without gut feelings or subjective interpretations. The focus is on stable momentum combined with consistent risk management. The aim is to create clear decision-making and a disciplined investment process – free from emotional mistakes.

In exceptional cases, we may make discretionary decisions to buy or exit, such as in the event of new issues, delistings, parabolic runs or other unusual events. Such decisions are rare and do not affect the foundation of the strategy – which is based on following the principles of Pure Momentum rather than “stock picking”.

We help investors make better decisions by offering structured methods with proven historical strength, rather than trying to predict the market’s next move. Momentum is one of the most robust anomalies in financial markets – unlike many other factors that appear and quickly disappear. But even the best strategy can fail if it is not followed.

Common mistakes include exiting positions too early, chasing overheated trends, ignoring exit signals, or taking too large positions. Many people allow themselves to be swayed by short-term volatility, lack of patience, and emotional decisions – which often undermines the long-term profitability of the strategy.

Discipline and risk management are crucial to success.

⚠️ RISK WARNING

Investing in financial markets always involves risk. Past performance is no guarantee of future results, and there is a possibility that you may lose all or part of your invested capital. Our analyses and indicators are based on historical data and statistical models, but these models cannot predict future market movements with complete certainty.

The value of investments may fluctuate significantly due to market conditions, company-specific factors and global economic events. It is important that you carefully consider your financial situation and your ability to bear potential losses before investing. The Service does not provide personal investment advice and recommends that you seek independent financial advice before making any investment decisions.

NeuroQuant employees may own or trade securities mentioned in analyses or based on indicators used in our services. This may potentially create conflicts of interest, but we strive for full transparency and professional integrity in all our activities. Following our analyses and indicators involves increased risk if the market moves in an unpredictable manner. You should only invest money that you are prepared to lose and understand that past performance, analyses or models provided through the service do not guarantee future results.