Update: Top Picks Momentum

Top Picks Momentum buys and sells stocks based on our Pure Momentum strategy. This strategy identifies low-volatility uptrends, with the assumption that these trends often last longer than expected.

A characteristic of momentum strategies is that a few big winners can account for a significant portion of the return. The strategy is based on following these winners while avoiding big losers.

Click here to read more about our factor-based equity strategies on the website.

Information

- Direction: Long-only (no short positions)

- Strategic direction: Moment

- Investment universe: Sweden (also Nordic)

- Portfolio weights: Volatility-adjusted

- Rebalancing frequency: Monthly

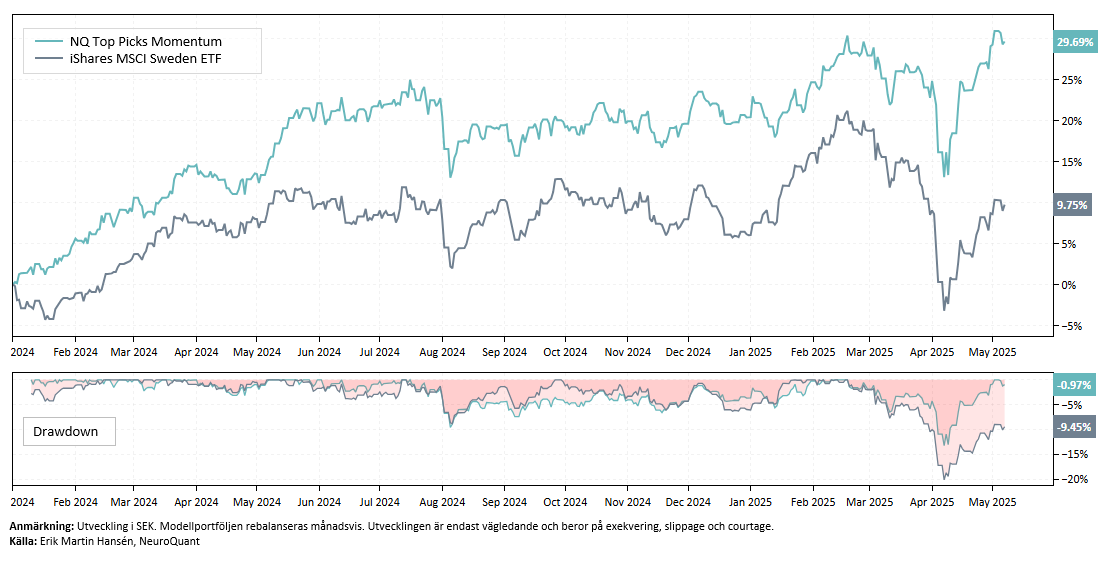

Development

Since January 2024, Top Picks Momentum has risen by around 30%, compared to the Stockholm Stock Exchange's rise of around 10%. Among the main contributors are Lundin Gold, Mildef Group and Ambea. On the downside, Wästbygg Gruppen, Surgical Science and XSpray Pharma have weighed the most on returns.

Monthly development (%)*

| Year | Jan | Feb | Mar | Apr | Maj | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total |

| 2023 | 8.8 | 1.3 | 1.4 | -0.4 | -0.6 | 2.1 | -2.1 | -4.4 | -2.7 | -0.2 | 0.5 | 3.7 | 7.0 |

| 2024 | 5.0 | 3.6 | 5.1 | -0.7 | 7.6 | -0.3 | 0.8 | -2.7 | 0.4 | -0.2 | -0.1 | 0.7 | 20.4 |

| 2025 | 3.6 | 2.6 | -4.0 | 5.1 | 0.5 | 7.7 |

*The development is indicative only and depends on execution, slippage and brokerage.

Holdings and portfolio weights

Holdings and portfolio weights in our factor-based equity strategies are included in the premium package and are available on the page Model portfolios.

Login required to view our model portfolios

Not a customer? Open an account to access our analytics service.