Update: Value & Momentum

Value & Momentum is a strategy that combines the factors of value and momentum to buy cheap companies that are trading with good momentum. Portfolio weights are adjusted for volatility and changes are made once a month.

Holdings and position sizes are included in the premium package and are displayed on the Model Portfolios page.

Keep in mind that factor-based equity portfolios have a high correlation to the stock market. After all, it is stocks that we buy. If the stock market falls, the equity portfolios are expected to fall.

With patience, discipline and systematic position management, we have a good chance of outperforming over time.

By updating the portfolio once a month instead of constantly adjusting it, the strategy has room to operate and function as it is intended to.

Development in 2024

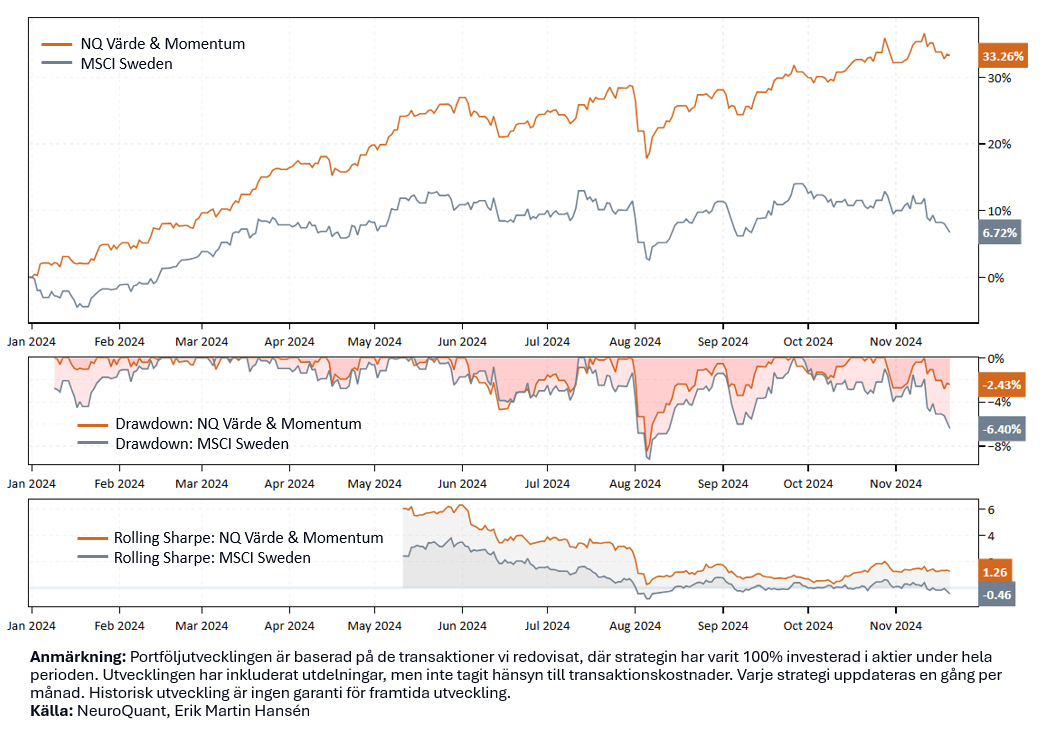

The Value & Momentum strategy has risen 33% so far in 2024, outperforming the stock market. The strategy has also had lower volatility and smaller maximum drawdowns compared to the Stockholm Stock Exchange, resulting in a higher risk-adjusted return.

The background to the rise in 2024 is the strategy's ability to identify and retain stocks such as Hoist Finance, Traton, Enea, CoinShares and Ambea, which have contributed strongly to the year's results.

Development, Year to Date

Development last month

Over the past month, the portfolio has increased by 0.5%, despite the stock market (MSCI Sweden) falling by 4.3% over the same period. So far in November, the strategy has risen by 0.8%.

| Jan | Feb | Mar | Apr | Maj | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total | |

| 2023 | -0.4 | -3.0 | 4.7 | 3.3 | -1.7 | 0.5 | 1.1 | -0.5 | 3.6 | 7.5 | |||

| 2024 | 4.2 | 4.4 | 6.7 | 3.1 | 6.0 | -2.0 | 3.4 | -0.4 | 1.8 | 1.4 | 0.8 | 33.3 |

Biggest positive contributors in the past month:

- CoinShares International: +1,3 %

- Host Finance: +0,4 %

- Must: +0,4 %

Biggest negative contributors in the past month:

- Drive away: -0,7 %

- Okeanis Eco Tankers Corp: -0,6 %

- Scandic Hotels: -0,6 %

Changes and holdings

Login required to view holdings in our stock strategies

Not a customer? Open an account to access our analytics service.