Update: Value & Momentum

Value & Momentum is a strategy that combines the factors of value and momentum to buy cheap companies that are trading with good momentum. Portfolio weights are adjusted for volatility and changes are made once a month. With patience, discipline and systematic position management, we have good conditions to outperform over time.

By updating the portfolio once a month, the strategy has room to operate and function as it is intended to. Keep in mind that factor-based equity portfolios have a high correlation to the stock market. After all, we are buying stocks. If the stock market falls, the equity portfolios are expected to fall.

Our factor-based equity strategies are included in the premium package. On the page model portfolios The holdings and portfolio weights are reported.

Click here to read more about our strategies on the website.

Information

- Direction: Long-Only (no short positions)

- Strategic direction: Attractive valuations and strong momentum

- Investment universe: Mostly Sweden, but can also shop the Nordic countries

- Portfolio weights: Volatility-adjusted (all holdings are allowed to participate and contribute equally)

- Rebalancing frequency: Monthly

Development

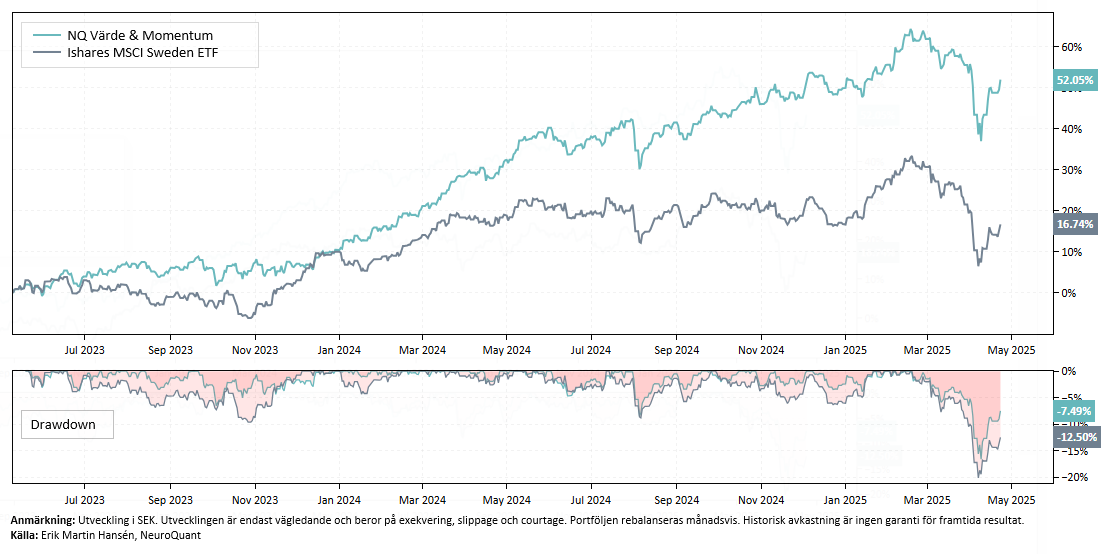

Since its inception in 2023, Value & Momentum has outperformed the Stockholm Stock Exchange, rising by a whopping 52%, with volatility (13%) that has been lower than the stock market's (15%). Tracking error against the index has been 10%, beta 0.7 and correlation 0.8.

So far in 2025, the performance is just above the zero line, which means that the strategy has performed slightly better than the Stockholm Stock Exchange, which shows negative returns Year to Date. The largest positive contributions during the year come from Clas Ohlson, Loomis and Humana.

| Year | Jan | Feb | Mar | Apr | Maj | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Total |

| 2023 | -0.7 | 4.7 | 3.3 | -1.7 | 0.5 | 1.1 | -0.5 | 3.6 | 10.5 | ||||

| 2024 | 4.2 | 4.4 | 6.7 | 3.1 | 6.0 | -2.0 | 3.4 | -0.4 | 1.8 | 1.4 | 1.0 | 1.6 | 35.7 |

| 2025 | 3.8 | 4.0 | -5.2 | -1.0 | 1.4 |

The development is only indicative and depends on execution, slippage and brokerage.

Holdings and portfolio weights

Holdings and portfolio weights in our factor-based equity strategies are included in the premium package and are available on the page Model portfolios.

Login required to view our model portfolios

Not a customer? Open an account to access our analytics service.